[adrotate group="2"]

Recently, the atebites X account revealed that THORChain’s lending service lacks sufficient bitcoin to repay its creditors. At the time, the total bitcoin owed to depositors was 1,604, while the lending pool held only 592 bitcoin.

We need to raise awareness about the precarious state of Thorchain lending, which poses risks to the protocol.

Currently, according to market rates for RUNE, full loan closure could mint 24 million RUNE.

1,604 in BTC collateral, 18,258… pic.twitter.com/OykZbMQCdx

— atebites (@ate_bites)

As explained by Shehzan Maredia, founder of Lava, borrowing from THORChain involves them selling the bitcoin you provide as collateral to acquire their token, RUNE. Upon repaying your loan, they sell the RUNE to return your collateral in bitcoin.

I predicted Thorchain’s collapse in 2023 when they introduced their “lending” feature, and it is unfolding. The lesson: any crypto system that can fail will. When borrowing on Thorchain, your BTC collateral was sold for their…

— Shehzan (@MarediaShehzan)

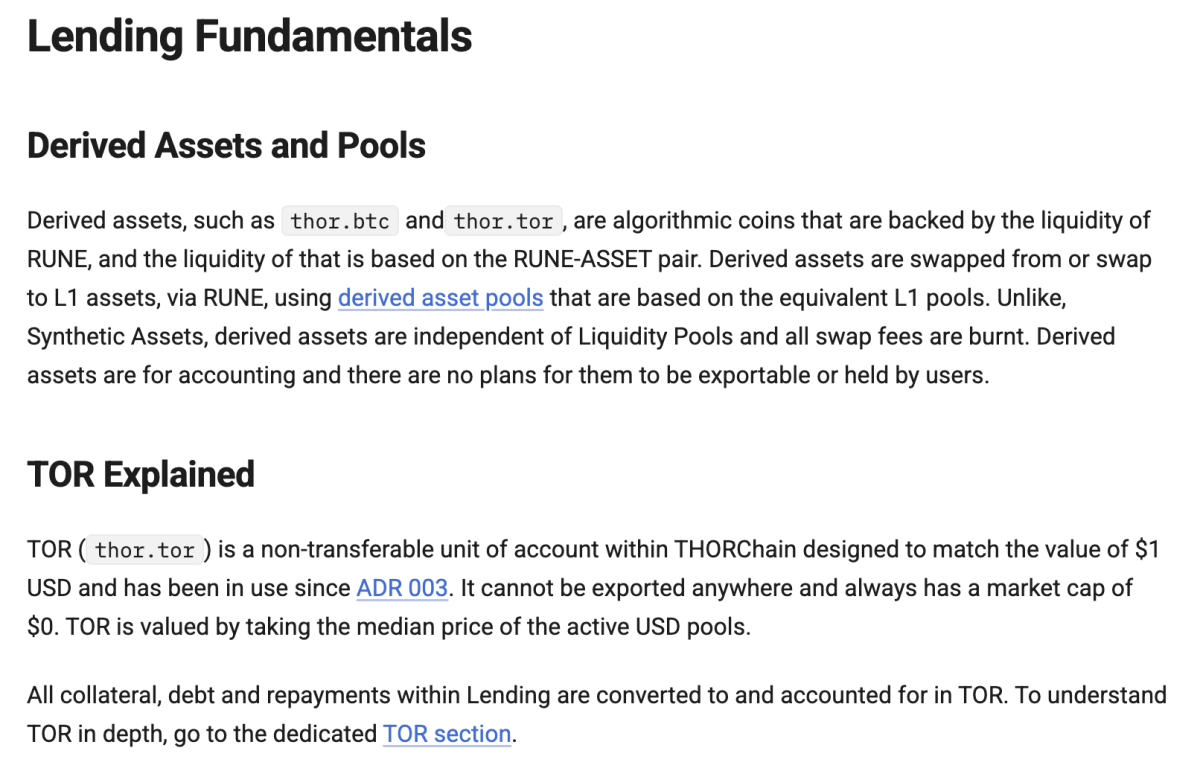

The process described is quite complex and is elaborated on THORChain’s official website.

See the screenshots from their website below:

The key issue here is that a significant portion of the value borrowed in U.S. dollars came when bitcoin prices were considerably lower than they are now, as noted by atebites. Thus, for THORChain to fulfill its current obligations, it may need to mint over 24 million RUNE (as of January 8). While this accounts for about 8% of RUNE’s circulating supply, it could negatively affect the asset’s price, reducing THORChain’s purchasing power as they attempt to buy back bitcoin for their creditors.

If traders were to begin shorting RUNE, it would further impede THORChain’s ability to acquire the bitcoin needed to satisfy its obligations.

This situation could potentially lead to a crisis similar to the Terra/Luna collapse witnessed in 2022.

Nonetheless, Erik Voorhees, a prominent advocate for the project, reassured that THORChain’s lending service is functioning as planned and no immediate threat exists:

Thorchain is operating as designed. Yes, loan redemptions might exert downward pressure on RUNE’s price, but the scale isn’t hazardous. If you’re concerned, feel free to pay off your loan.

— Erik Voorhees (@ErikVoorhees)

A core THORChain developer, known as Nine Realms on X, also argued that THORChain remains robust:

1/ Addressing Community Concerns

There has been considerable discussion recently about the network’s state and the outstanding liabilities of the lending protocol. Let’s explore the facts to clarify what’s truly happening and why we’re confident in THORChain’s resilience.

— Nine Realms (@ninerealms_cap)

If you’re feeling uneasy about having lent your bitcoin as collateral for a loan with THORChain, consider redeeming it. Personally, I would.

The views expressed in this article are those of the author and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.

[adrotate group="2"]