[adrotate group="2"]

THE SECRET WEAPON IN THE TREASURY: SCOTT BESSENT’S BOLD PLAN TO CRUSH BOND YIELDS!

Hold onto your wallets, folks! Treasury Secretary Scott Bessent is on a relentless mission to slash 10-year bond yields, and he’s not holding back! In a whirlwind of speeches and interviews, this financial firebrand is stirring up Wall Street and flipping the script on market predictions—all while promising widespread economic transformation!

THE BOMB DROPS: WALL STREET IN DISARRAY!

In a shocking turn of events, top strategists from Barclays, Royal Bank of Canada, and Societe Generale are scrambling to revise their year-end forecasts, thanks to Bessent’s aggressive moves to drive yields lower. This isn’t just talk—this man is wielding real power! From limiting 10-year debt auctions to advocating for regulation rollbacks and rallying behind Elon Musk’s desperate attempts to reign in the budget deficit, Bessent means business!

“DON’T FIGHT THE TREASURY!”—A NEW MANTRA EMERGES!

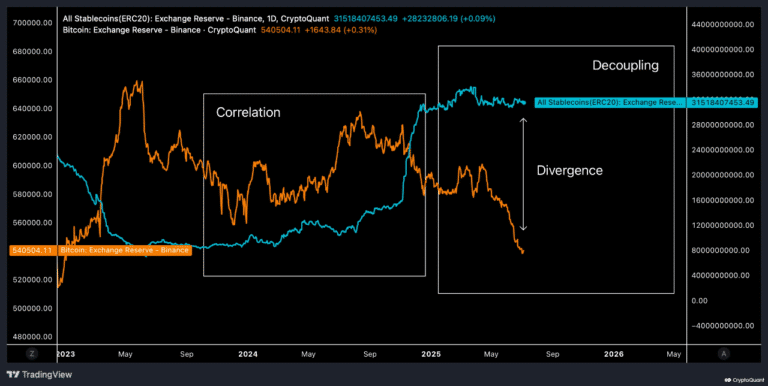

As bond yields tumble by a jaw-dropping half-percentage point in just two months, analysts are chanting a revolutionary new mantra: “Don’t fight the Treasury!” Bessent’s actions—and yes, his relentless rhetoric—are changing the game. It’s a phenomenon that’s sparking fears of a recession, pushing terrified investors into the safety of bonds. But don’t be fooled—this isn’t the yield rally Bessent envisioned; it’s a frantic escape from economic turmoil!

THE ROLLERCOASTER AHEAD: WILL YIELDS SPIKE BACK UP?

Brace yourself, because with the stock market always lurking and inflation refusing to budge, Bessent’s bond dreams could be crushed overnight! In an exclusive tell-all with Breitbart, Bessent confidently declared that massive budget cuts will naturally lower interest rates—a bold claim he’s reiterated on major networks. He’s pushing for lower taxes and reduced energy prices to ramp up economic output.

THE BESSENT PUT—A BOND MARKET GAME-CHANGER!

Speculation is swirling like a whirlwind in the bond world with the rise of the “Bessent put.” This isn’t your run-of-the-mill financial tool; it’s a radical shift reminiscent of the old Greenspan put where central bank intervention was king! Daring investors are snapping up 10-year inflation-linked notes, betting on Bessent’s vow to keep long-term yields in check.

And wait—there’s more! Last month, Bessent shocked Wall Street with a plan to maintain the sale of longer-term debt, even as he slammed his predecessor for manipulating bond issuance. He’s not just a man of words; he’s taking bold steps!

THE ADMINISTRATION THAT WON’T BACK DOWN!

Described by experts as a "bond vigilant administration," Bessent’s concrete actions are having a profound impact on lowering bond yields. Experts predict that if yields start trending upward, Bessent won’t hesitate to wield his power again by slashing 10-year issues.

THE FINAL CALL: IS THIS A NEW ERA FOR BONDS?

With Bessent at the helm, the future of bond yields hangs in the balance. Are we on the brink of unprecedented changes in how the Treasury shapes the financial landscape? Only time will tell, but one thing’s for sure: Scott Bessent is a force to be reckoned with, and the bond market will never be the same again! Buckle up!

photo credit: fortune.com

[adrotate group="2"]