[adrotate group="2"]

TRUMP TARIF-CAUST: THE ECONOMIC EARTHQUAKE STRIKES AGAIN!

Brace Yourself! The Trade War is Intensifying!

President Trump’s long-awaited Tariff Tsunami has already begun, and the economic world is holding its breath! Since 1989, the Donald has been champing at the bit to impose hefty taxes on foreign imports. First, it was Japan. Now he’s got his sights set on Canada, China, Mexico, and Europe!

In an explosive move, Trump has slapped a 10% levy on Chinese imports, and while Mexico and Canada dodge a 25% tariff bullet for now, they’d better play nice on border security—because the clock is ticking!

Turbulence Ahead: More Tariffs Incoming!

Get ready for more bombshells! Trump isn’t shying away from short-term pain for what he claims could be long-term gain! Stocks are crashing, and smart investors are freaking out. But here’s the scoop: those in the know aren’t sweating it! While the market is full of "tariff losers," savvy contrarians are turning their attention to the ultimate safe haven—bonds!

The Bond Market Won’t Blink! What’s Going On?

Despite the ongoing trade war chaos, the bond market remains surprisingly calm. The 10-year yield has hit a wall just below the 5% ceiling! If tariffs were the inflationary nightmare everyone fears, wouldn’t investors be freaking out? Instead, bonds are standing firm, signaling that these tariffs could just be a bump in the road!

What’s the real story? Contrary to popular panic, studies reveal that tariffs might not be the inflation machines we’re led to believe! In fact, they could be trashing economic growth instead!

Look to Bonds and Preferreds for Big Gains!

With the stock market in turmoil, wise investors are loading up on bonds and their close relative, preferred stocks. These “hybrid” investments combine the best of both worlds, offering fixed dividends and stability unlike anything you’d find in traditional stocks.

Top 3 Preferred Closed-End Funds Ready to Explode!

Here are three must-have preferred closed-end funds (CEFs) that are offering eye-popping yields—some reaching up to a jaw-dropping 10.5%!

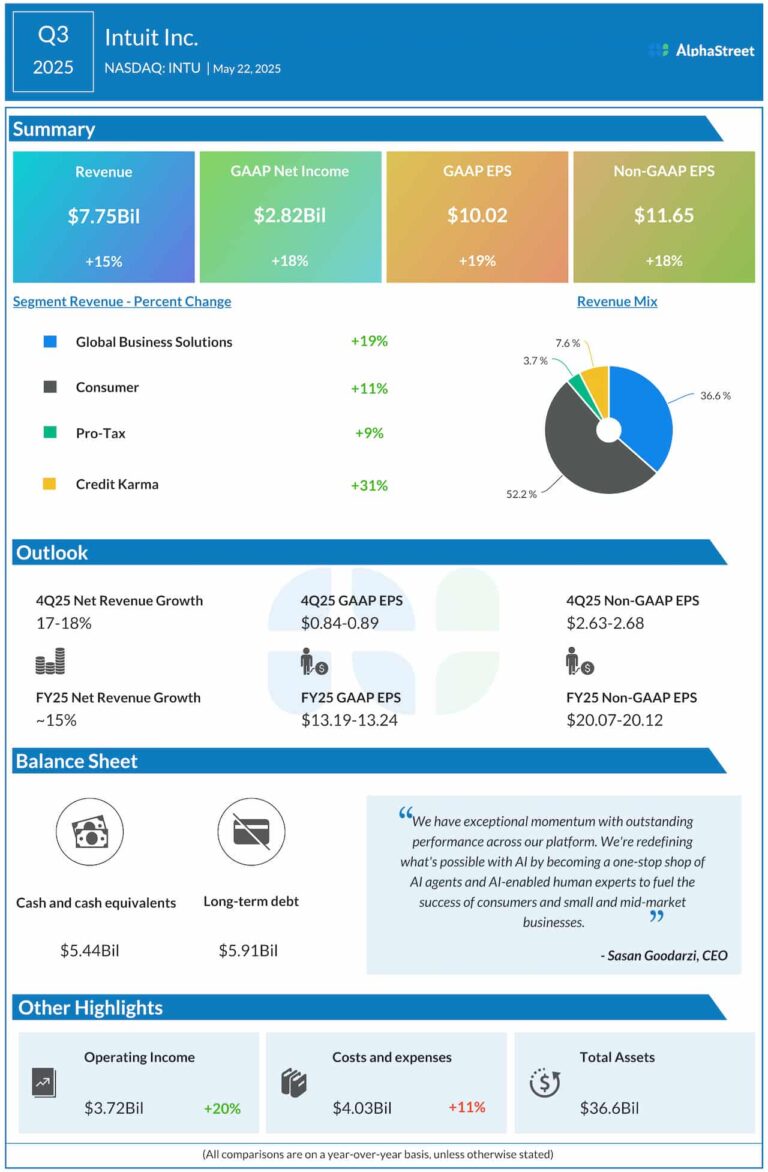

1. Cohen & Steers Limited Duration Preferred and Income Fund (LDP)

- Distribution Rate: 7.5%

- Discount to NAV: 4.9%

This isn’t your run-of-the-mill fund! LDP targets low-duration preferred stocks to shield investors from interest rate spikes, sprinkling a bit of magic dust on your dividends with 33% debt leverage!

2. Flaherty & Crumrine Preferred Securities (FFC)

- Distribution Rate: 6.9%

- Discount to NAV: 6.8%

FFC is a global powerhouse, loaded with financial sector assets. While it boasts an aggressive approach with almost 40% leverage, the risk isn’t for the faint-hearted—but oh the rewards!

3. Nuveen Variable Rate Preferred & Income Fund (NPFD)

- Distribution Rate: 10.5%

- Discount to NAV: 4.9%

In a world awash with fixed dividends, NPFD swings for the fences with variable rates! Despite its rocky debut amidst the market turbulence, it’s the only one of the trio showing positive total returns since launch.

Time is Ticking, Don’t Miss Out!

As the tariff storm brews and the market shakes, these preferred CEFs are positioned to deliver robust returns. Don’t miss this golden opportunity to supercharge your portfolio amidst the chaos. The market may be wild, but the wise know where to turn!

Stay informed, stay savvy, and capitalize on the impending wave of opportunity!

[adrotate group="2"]