[adrotate group="2"]

BANKING BATTLE: Will Overdraft Fees Be DOOMED?

Americans partied when the government promised to slash those pesky $35 overdraft fees! But hold on to your wallets, folks! Washington is shifting gears and it’s anyone’s guess if that change will ever see the light of day!

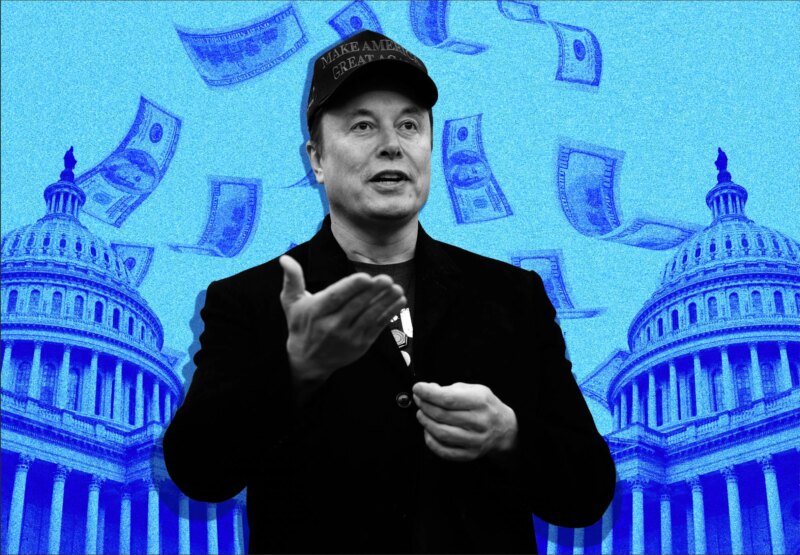

TRUMP AND MUSK’S POWER MOVE: Could Overdraft Fees Be Here to Stay?

In a shocking twist, President Trump and Tesla’s big shot, Elon Musk, are gunning to obliterate the power of the Consumer Financial Protection Bureau — the agency that was set to help you save a fortune! If they succeed, those soul-crushing overdraft fees could come roaring back to life!

Banks like Citi and Capital One may have ditched the fees already, but not everyone is playing nice. Heavyweights like JPMorgan Chase and Wells Fargo are still raking in millions from those outrageous $34 to $36 charges! Yep, they’re practically banking on the Trump administration tossing out the Biden-era rule.

EXCLUSIVE: CFPB ON THE CHOPPING BLOCK?

Back in December, the CFPB announced a fiery ultimatum: cap those excessive overdraft fees by October 2025! But now? Congress is trying to FIGHT BACK! With Rep. French Hill and Sen. Tim Scott leading the charge, this rule is in serious jeopardy.

Banks are pushing back HARD in the courts too, claiming they NEED those fees to provide “liquidity” for their customers. Seriously? They’re saying your financial pain helps them do business! Unbelievable!

UNDER ATTACK: The Fate of Overdraft Relief HANGS IN THE BALANCE!

CFPB Interim Director Russell Vought is singing a different tune. He’s ecstatic about rolling back the new rule—showing allegiance to Trump’s deregulatory agenda. Just weeks ago, Trump fired the previous director, setting the stage for a massive overhaul of consumer protections.

With the agency facing an identity crisis, experts warn that it’s the average American who stands to suffer from big banks kicking back into high gear!

Lauren Saunders from the National Consumer Law Center is furious, accusing the Republican troops of siding with the banking giants at the expense of everyday families. Her organization is already suing to thwart these reckless dismantling efforts!

NO MORE OVERDRAFT FEES? Not If These Banks Can Help It!

Let’s spill the tea on what the banks are doing while the drama unfolds:

- Wells Fargo: Slaps a hefty $35 overdraft fee on you! They pulled in a staggering $937 million last year!

- JPMorgan Chase: They’ll charge you $34 if your balance dips over $50. And they pocketed a jaw-dropping $1.1 billion in overdraft fees!

- Bank of America: Reduced their fee to $10—better than before, but still irrelevant if it’s your money! They racked up $140 million on fees last year.

- U.S. Bank: The renegade still charges a whopping $36 fee and made $214 million off of it!

- Citi: The hero! They got rid of overdraft fees entirely and declared: “We’re not going back!”

- PNC: Charges $36, but hey, only once a day, folks! They took home $258 million from fees last year.

- Capital One: They’re waving goodbye to ALL overdraft fees! A spectacular move that’s part of their mission.

STAY TUNED, AMERICA: The Overdraft Fee Fight is FAR from Over!

As the battle brews in Congress and the courtroom, the real winners—or losers—might just be you, the consumer. Will you be freed from the chains of overdraft fees? Or are we looking at a financial free-for-all? Only time will tell, but hold on tight to your wallets; we’re in for a wild ride!

photo credit: money.com

[adrotate group="2"]