[adrotate group="2"]

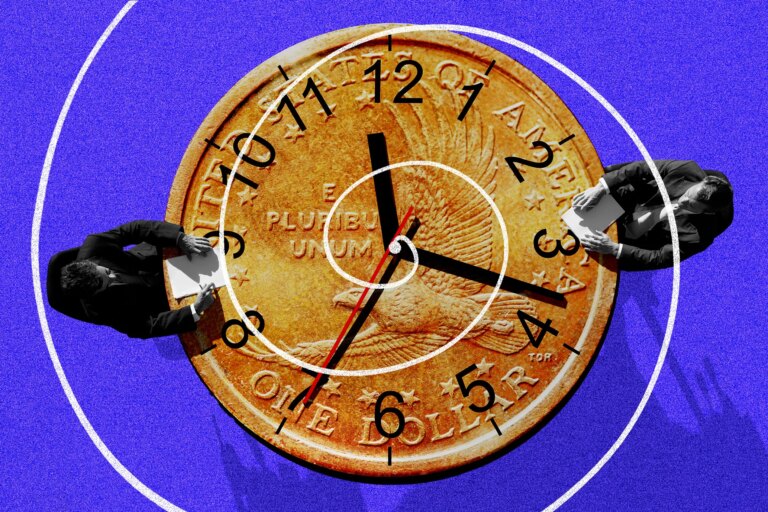

DISASTER ALERT: Dealmaking Goes Cold as Stock Markets Dive!

Nation’s Financial Titans Stunned by Market Crash and Uncertainty!

Get ready for a tumultuous ride, folks! The dealmakers of Wall Street are sweating bullets as they confront a shocking slowdown in activity that threatens to derail their ambitions. As stock markets tumble and policy uncertainties rage like a wildfire from the new Trump administration, the dream of a booming takeover season is fading fast!

Buckle Up! Takeovers Hit Crisis Levels!

Unless you’ve been living under a rock, you know the numbers are grim. With only 6,600 global transactions recorded this quarter, we’re staring at the slowest deal-making pace in OVER A DECADE! That’s down nearly 30% from last year and a staggering 44% off the highs of 2021! Forget the so-called “Trump bump”—we’re witnessing a full-on crash!

Wall Street’s Desperate Attempts to Ignite Dealmaking!

Wall Street has been frantically trying to breathe life back into M&A for two whole years after interest rate hikes crushed the pandemic-era boom. What once looked like promising “green shoots” has now turned into a seriously bleak situation. CEOs are practically paralyzed with fear about the future. As if that wasn’t enough, Trump’s tariffs are throwing a monkey wrench into any chance of planning for the next big coup!

S&P 500 Plummets! Fears of Economic Catastrophe Grip Wall Street!

Traders are out for blood as worries about the economy send the S&P 500 spiraling downward—down nearly 4% already this year! That’s enough to send chills down anyone’s spine!

FCC to Call the Shots on Deals! Are Companies on the Chopping Block?

Shockwaves are reverberating as the Chair of the FCC warns he might BLOCK deals if he detects “invidious forms of discrimination”! Antitrust enforcement under the Trump administration is shaping up to be WAY more aggressive than anyone dared to imagine. Forget smooth sailing—this is a stormy sea!

The VALUE Game: Megadeals on the Horizon!

Surprisingly, the total value of takeover offers has climbed by 14% this year to around a whopping $812 billion—but let’s keep it real: that’s buoyed by just a few gigantic transactions! Google’s parent company, Alphabet, is making waves with a near $32 billion buyout, while BlackRock is diving into a $23 billion port-buying spree! But these isolated incidents only add to the tension as the broader market remains in CHAOS!

Caution is King! CEOs Knocked Off Balance!

Bankers and lawyers are feeling the heat. Despite a fervent appetite for deals, many executives are stepping back, reluctant to push the trigger on any transactions. The message is clear: the market’s already shaky ground has most on high alert!

IPOs Stumble as Hopes Wane! What’s Next?

The IPO market is dead on arrival! Despite some brave companies attempting to launch, the overall proceeds this year are only a slight increase over last—totally pathetic compared to 2021 and 2022!

Hiring Frenzy Fizzles Out! Financial Powerhouses in a Bind!

As the markets falter, big banks are scaling back their hiring plans! Even Goldman Sachs, known for its hustle, is teetering with junior banker positions as teams face fewer deals. If you think the market’s volatile now, just wait!

Deals on the Brink! Will the Market Bounce Back?

Will the deal-making scene return to life?! Experts cling to hope, asserting that more clarity on antitrust policies could unleash a flurry of deals that are currently on the sideline. But for now, uncertainty reigns supreme and skepticism looms large!

Strap in, because this financial rollercoaster is just getting started! The stakes have never been higher, and the tension is palpable! Will we rise to new heights or plunge into deeper chaos? Only time will tell!

photo credit: www.ft.com

[adrotate group="2"]