[adrotate group="2"]

TARIFF TRAP: TRUMP’S ROLLERCOASTER CAUSES CHAOS IN MARKETS!

SHOCKING NEW TWIST: PRESIDENT HITS PAUSE, BUT AT WHAT COST?

Hold onto your hats, folks! President Donald Trump has tossed yet another grenade into the volatile arena of the trade war, showering us with a delicious but dangerous mix of excitement and anxiety. With his latest announcement to exempt consumer electronics and essential tech components from steep tariffs, we are witnessing a wild stock market rally that could leave many roaring with profits! But beware—the ripple effects on bonds and currency markets tell a different, darker tale!

GAME-CHANGING 90-DAY FOOTBALL!

Just this Wednesday, US stock indexes shot up like a rocket after Trump revealed a jaw-dropping 90-day pause on certain tariffs. However, the stakes rise as he escalated taxes for China, and let’s not forget the $6 trillion in market cap vaporized by his "Liberation Day" tariff shock last month! But don’t pop the champagne just yet. Up in the clouds of stock gains, dark clouds gather over bonds and currency!

EXTRAORDINARY EXEMPTIONS: ARE THEY A BLESSING OR A CURSE?

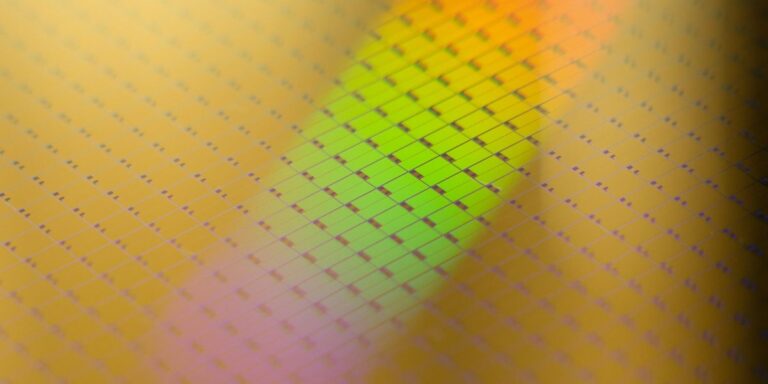

Late-night whispers from US Customs and Border Protection brought some jaw-dropping guidance—exemptions for smartphones, computers, semiconductors, and more! Analysts are calling this the “best possible news for tech investors,” and you can bet stocks are poised for a frenzy when the market reopens. But hold on! While stock investors indulge in their greed, the bondholders are restless, sensing more trouble ahead.

BOND BUST: TREASURIES IN FREE FALL!

Despite a momentary reprieve for Treasury yields following Trump’s tariff pause, their climb has resumed, signaling panic as bond markets dive even as stocks soar. Former Treasury Secretary Larry Summers warns that bonds are behaving like those from emerging markets! The once-untouchable allure of the US dollar seems to be unraveling, and leading experts are shaking their heads in disbelief!

DE-DOLLARIZATION DRAMA: A WORLD TURNING AWAY!

As global confidence in US assets plummets, esteemed experts like Deutsche Bank’s George Saravelos scream from the rooftops, "The market is rapidly de-dollarizing!" The hollowing out of trust in the almighty dollar is upon us quicker than anyone expected. Minneapolis Federal Reserve’s Neel Kashkari chimes in, noting that even hefty tariff hikes haven’t given the dollar the boost it craved—investors are making a mad dash for the exits!

CURRENCIES IN CRISIS: GOLD’S TIME TO SHINE!

Throughout history, we’ve seen predictions of the dollar’s demise fail to materialize, but this time it feels different! With governments amassing gold and countries using alternatives to the dollar for trade, the momentum is shifting dramatically. The stench of tariff-induced fear is wafting through the air—a cacophony of uncertainty is echoing through Wall Street!

IS THIS THE END OF AMERICAN EXCEPTIONALISM?

As we edge closer to a potential fallout from Trump’s aggressive tariffs—the highest seen in over a century—the world is taking note. Traditional allies are growing mistrustful, marking the dawn of a possible schism that could redefine global finance forever!

BEWARE: THE DAMAGE IS DONE!

Make no mistake, the storm is brewing, and the snake eyes of investors are watching closely as the markets feel the quake of uncertainty. The structural allure of the dollar’s reign is being hotly scrutinized as we plunge into this harrowing cycle of rapid de-dollarization. Get ready—this dramatic saga is far from over!

photo credit: fortune.com

[adrotate group="2"]