[adrotate group="2"]

TARGET IN CRISIS! SHOCKING TURNAROUND PLAN REVEALED AS EARNINGS DAY LOOMS!

Is Target’s Comeback Plan Enough to Save It from the Edge?

Target Corporation (TGT) is in a tailspin! With its stock plummeting a jaw-dropping 39% over the past year, the retail giant is scrambling to claw its way back from the brink. A massive overhaul is underway, featuring juicy investments in digital capabilities and a supply chain revamp aimed at saving face with consumers!

Earnings Catastrophe Approaches!

Mark your calendars—May 21 at 6:30 AM ET is the moment of truth! Analysts predict TARGET’s first-quarter earnings could nosedive down to just $1.73 per share, a steep drop from last year’s $2.03. The anticipated net sales for the April quarter? A flat $24.46 billion—yikes!

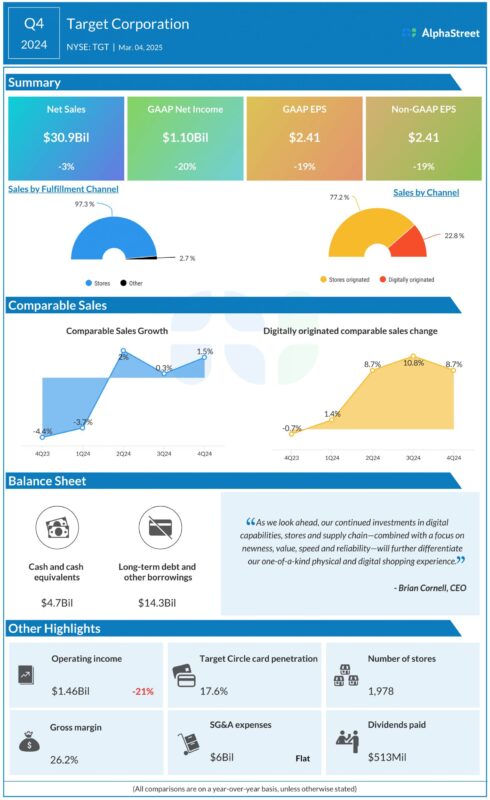

Last quarter was grim too: Target raked in $30.9 billion, a 3.1% tumble compared to the previous year. Yet, silver linings appear with a 1.5% bump in comparable sales, thanks to a staggering 8.7% spike in digital sales. But hold on! Even that victory came with a 20% cut in net earnings—down to $1.10 billion!

Bleak Future Forecast!

Sizzling hot-off-the-press, leadership warns of more dreary times ahead. FY25 sales are expected to limp along with only a 1% increase, while comparable sales are predicted to remain flat.

Boss Brian Cornell didn’t sugarcoat it! He revealed plans for a whopping $4 to $5 billion investment this year—hoping to ignite over $15 billion in revenue growth over the next five years! The company is poised to unleash more than 20 new stores and revamp scores more!

TEETERING ON THE EDGE!

Despite being a beloved shopping haven for many, competition and rising costs are gnawing at Target’s profits like hungry rats! And let’s not forget those pesky tariffs that hit them hard, especially on goods from China. Though trade tensions are easing, the price tag on new tariffs could keep squeezing those already-thin margins!

The latest buzz? Target’s stock is fighting to stay afloat, trading lower as investors hold their breath. The last close is glaringly below the 52-week average of $135.18!