[adrotate group="2"]

GENERAL MILLS IN DEEP TROUBLE: Q1 2026 EARNINGS ROAR ON THE HORIZON!

Brace Yourselves! General Mills’ Earnings Could Spell Disaster!

Ladies and gentlemen, mark your calendars! On September 17, right before the stock market opens, the iconic General Mills, Inc. (NYSE: GIS)—the mastermind behind beloved brands like Cheerios and Pillsbury—is set to drop some bombshell earnings news, and it ain’t looking pretty!

Sales Plunge! Investors Anxious!

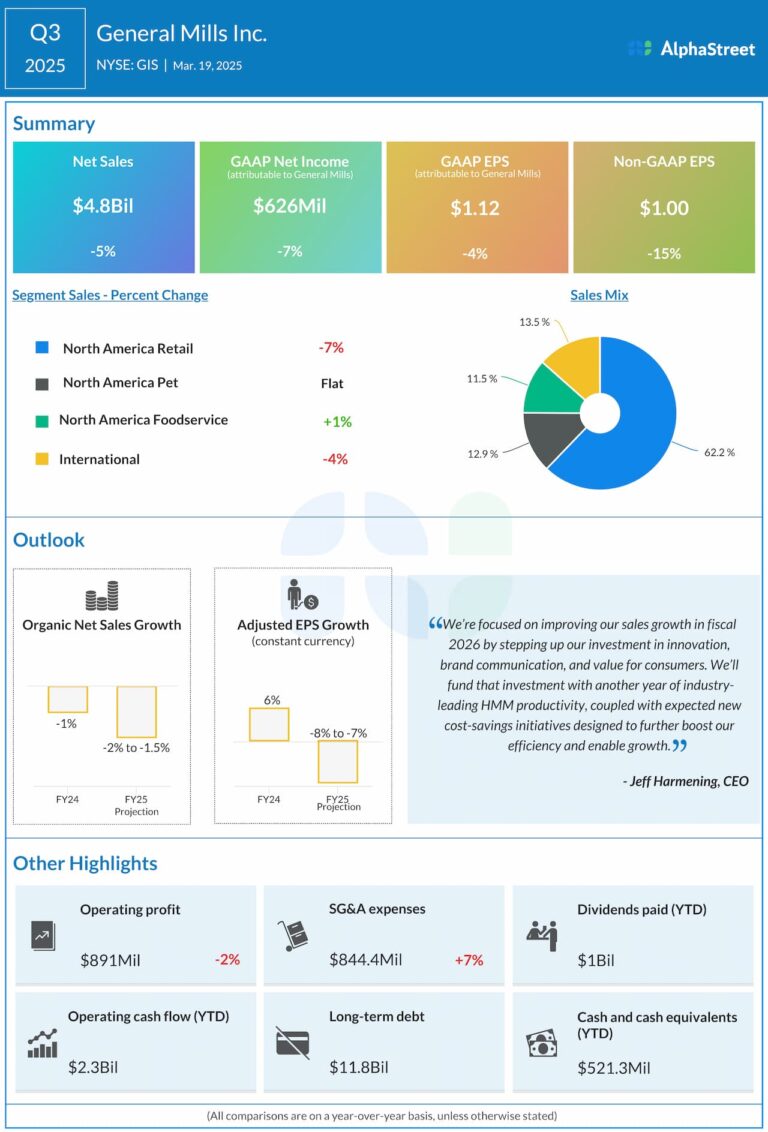

The beloved food giant is wrestling with plummeting sales volumes and margin pressures that are threatening its very existence. Customers are tightening their belts, spending less on their favorite products, and ditching name brands for cheaper private labels. Forget cereal; it’s a cereal crisis! Even pet food is feeling the cold shoulder!

CRUNCH TIME: Slim Earnings Ahead!

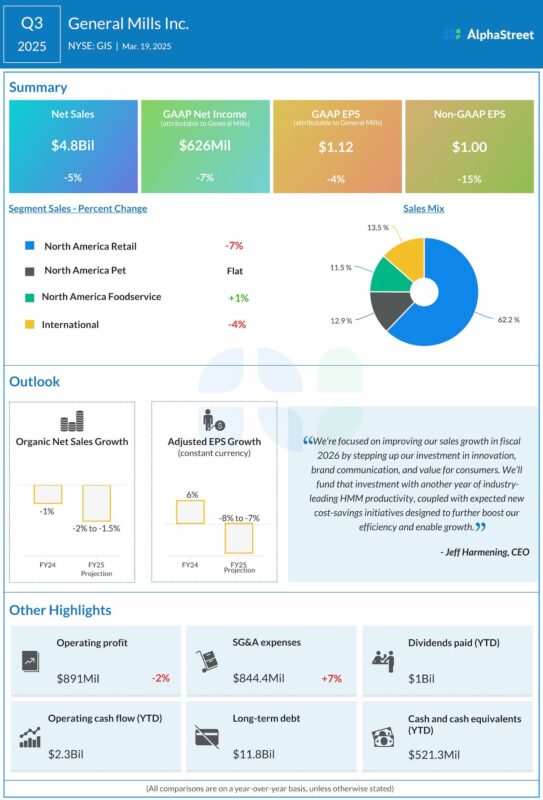

Wall Street analysts are bracing for disastrous results: an expected adjusted earnings of just $0.82 per share on a staggering $4.52 billion in revenue. This is a massive drop from last year’s $1.07 per share and $4.85 billion—a heart-stopping decline that screams, “We’re in trouble!”

Investors Scream, “SELL!”

General Mills’ stock has been on a relentless downward spiral—approaching a devastating one-year low! Fear is gripping investors as they watch the company’s performance fade into the shadows. With weak sales and a grim outlook from management, confidence is plummeting faster than the stock price itself.

Fourth Quarter: A Bloodbath of Earnings!

Last quarter, General Mills saw net sales tumble by 3% to $4.56 billion while organic sales fell a staggering 3% as well. Adjusted earnings per share nose-dived by 27% to $0.74. Even though they technically beat estimates, the reality is far scarier: net earnings slashed by a shocking 47% from last year! Talk about a train wreck!

The Management Desperately Scrambles!

Here’s the kicker: management is desperately trying to put a shiny spin on the situation. They claimed to boost investments in brands like Pillsbury and Totino’s in hopes of reviving fortunes. But can fancy marketing save them now?

The Road Ahead—Worrying Trends!

Ready for more bad news? Their forecast paints a bleak picture—organic sales could drop 1% to 1% growth in fiscal 2026, with adjusted earnings down 10-15%! Inflation is biting hard, and consumers are steering towards cheaper products. What more could go wrong as input costs, unfavorable pricing, and supply chain hiccups continue to crush margins?

The Bottom Drops Out of Stock Prices!

Currently, General Mills shares are hovering slightly above $50, a full 22% drop over the last six months! Their average stock price for the year has been $59.54, making this fall a gut-wrenching reality check for investors.

Stay tuned, folks! General Mills is on the brink, and you won’t want to miss what unfolds when the earnings bell rings! Will it be a last-minute save, or will the Giants finally crumble? Only time will tell!

[adrotate group="2"]