[adrotate group="2"]

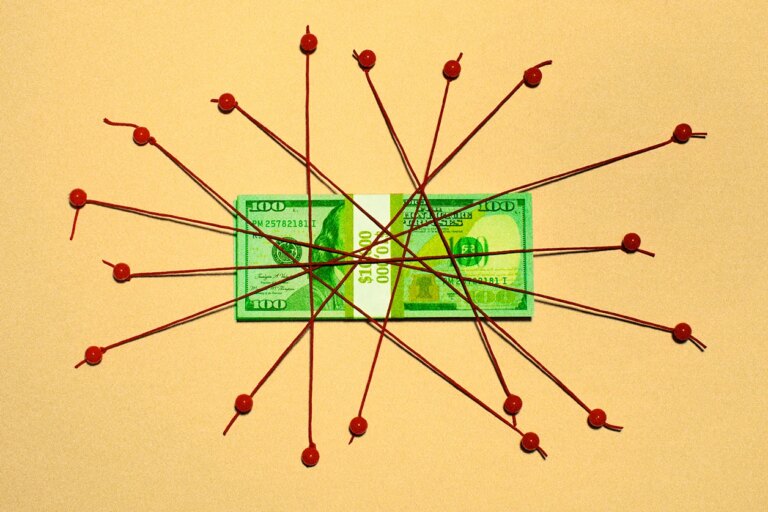

TELECOMS ON FIRE! BOLD PROFITS AND ROCKETING STOCKS IN 2025!

The UK’s telecoms stocks are lighting up the market, raking in sensational profits like never before! With a tidal wave of investors flocking to European value stocks, can this high-octane sector keep revving its engine in the next 12 months? Let’s dive deep into the electrifying predictions for BT, Vodafone, and Airtel Africa!

BT: A THRILLING RIDE BUT NO FURTHER FUEL IN THE TANK?!

BT has been on an epic journey, zooming up 40% this year! But hold your horses—analysts predict the average target price is just 200p, a steep 4% drop from current levels. Is this the end of the line for BT’s growth?

While they project a 4% dividend yield over the next year, many insiders believe there’s not much left in the tank for capital gains. With a P/E ratio of 11.5 and a mountain of debt looming above, it’s hard to see BT soaring any higher. Sure, whispers of AI efficiency are swirling, but for now, it’s a firm “no buy” from here!

AIRTEL AFRICA: THE ROCKET SHIP OF THE TELECOMS WORLD!

Airtel Africa is crushing it—up a jaw-dropping 75% this year! But don’t get too carried away; analysts warn it might be soaring just a bit too high, with an average target of 186p, nearly 11% below its current price of 208p.

Despite a potential pullback, Airtel’s impressive revenue growth of 18% to $5.8 billion this financial year has investors buzzing! Even though its P/E ratio of 19 might send shivers down your spine, earnings are set to shoot up, meaning this stock could very well grow into its valuation.

Beware, though! The wild volatility of African markets could pose some serious risk, but for long-term players, Airtel Africa is a penny stock worth watching!

VODAFONE: A DARK HORSE READY TO STUN WITH A SURGE?

Finally, Vodafone—once the underdog of telecoms—is grabbing attention with a price target of 87p, offering a tasty 5% bump above its current price. After years of negativity, could Vodafone be staging a comeback?

Analysts predict a monstrous 17% jump in earnings per share to €9.70 in the upcoming financial year! With a strong chance to catch up to its rivals—the stock has only seen a 20% increase this year—Vodafone is ready to rumble.

But hold up; with a P/E of 11.4 and a heavy debt load, risks lurk around every corner. There may be better investments elsewhere, but don’t count Vodafone out just yet!