[adrotate group="2"]

Shockwaves in the Fry World: Lamb Weston on the Brink! 🥔💔

Stock Struggles: Lamb Weston Plunges 19%—Will Earnings Save the Day?

Lamb Weston Holdings, Inc. (NYSE: LW), the titan of frozen potatoes, is in hot water! Despite managing to keep its stock “green” on Friday, the company has faced a staggering 19% decline over the past three months. As the countdown begins to their third-quarter 2025 earnings reveal on Thursday, April 3, just before the market opens, the stakes couldn’t be higher!

Revenue Rumble: Can They ‘Fry’ Up Sales?

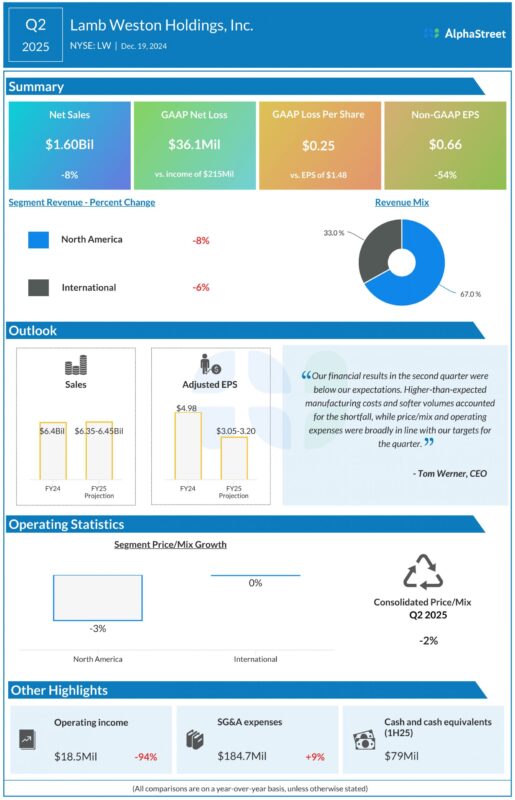

In a nail-biting twist, analysts predict a revenue of $1.5 billion for Q3 2025—up slightly by over 2% year-over-year! But don’t pop the champagne just yet; the preceding quarter saw net sales nosedive by 8%, landing at a disappointing $1.6 billion. Can Lamb Weston turn this ship around, or are they destined to drown in potato peels?

Earnings Shock: A Bottomless Pit?

Hold onto your hats—analysts are eyeing a consensus target for Q3 earnings at $0.87 per share, representing a staggering 27% drop from last year! With adjusted earnings per share crumbling by 54% to just $0.66 last quarter, the pressure is on! Will this earnings report be a beacon of hope or an announcement of doom?

Crisis Mode: Desperate Struggles in a Competitive Fry Market!

The potato powerhouse is grappling with a brutal operating landscape! Soft demand for frozen products and aggressive competition threaten to choke profits. Lamb Weston foresees these relentless challenges sticking around through fiscal year 2025 and possibly into 2026, forcing them to slice their annual guidance like a bad potato! 🌧️

In a harrowing blow, Q2 performance slumped below expectations, hurt by soaring manufacturing costs and depleting volumes—down 6%—as restaurants across the U.S. face dwindling traffic. Add to that a nasty customer share loss thanks to cutthroat competitors! While the exit from some low-margin businesses in Europe may lighten the load, this is not enough to stop the juggernaut from teetering!

Fry Sizes Shrinking: Will It Hamper Volumes?

Desperate times have led to desperate measures! As U.S. quick service restaurants (QSRs) ramp up promotions, they’re also downsizing fry portions, adding more woes to volume forecasts. Fans of French fries beware!

And it gets worse! LW expects volume pressures ahead, particularly after losing a key chain restaurant client and the massive pinch from reduced serving sizes. International markets aren’t safe either—customer losses and sluggish traffic could spell disaster!

But wait, could new customer wins and recovering lost shares be a silver lining? Lamb Weston is forecasting sales of $3.1-$3.2 billion for the second half of the year, which could bring a glimmer of hope with a modest growth of 1-4% YoY.

Restructuring Relief? Are Cost Cuts the Answer?

In a last-ditch effort to salvage the situation, the potato mogul is betting on their restructuring plan. By slashing production lines, trimming headcounts, and curbing unnecessary expenses, could Lamb Weston squeeze out the savings they desperately need?

As the fry saga unfolds, all eyes will be glued to April 3rd! Can Lamb Weston shake off the impending financial doom, or is this just the beginning of their crispy downfall? 🥔🔥

[adrotate group="2"]