[ad_1]

Target’s Downward Spiral: Earnings Disaster Looms!

Target Corporation (TGT) SHOCKS Investors with Dismal Start to Fiscal Year!

In a jaw-dropping revelation, Target has plummeted into a financial abyss, with sales and profits DOWN drastically compared to last year! With crushing inflation and economic chaos strangling the retail world, Target finds itself among the hardest hit by these violent market forces.

Earnings Report Countdown: Can Target Pull a Rabbit Out of the Hat?

Get ready, folks! The anticipation is building as Target prepares to unveil its second-quarter earnings on August 20! Analysts are holding their breath, hoping for a miracle amidst the chaos. Predictions are grim—earnings expected to crash to $2.00 per share, a steep fall from last year’s solid $2.57. Sales are also looking bleak, with a predicted 2.3% drop YoY, landing at $24.87 billion.

Target’s Share Price Plummets: Is There Any Hope Left?

The horror continues as Target’s stock dives deeper, still reeling from its recent multi-year low! It’s been a DISASTROUS year for shareholders, with TGT down over 20% in the past 12 months and more than half its value GONE since the glory days of November 2021.

Fiscal 2025 Q1 Results: A Financial Train Wreck

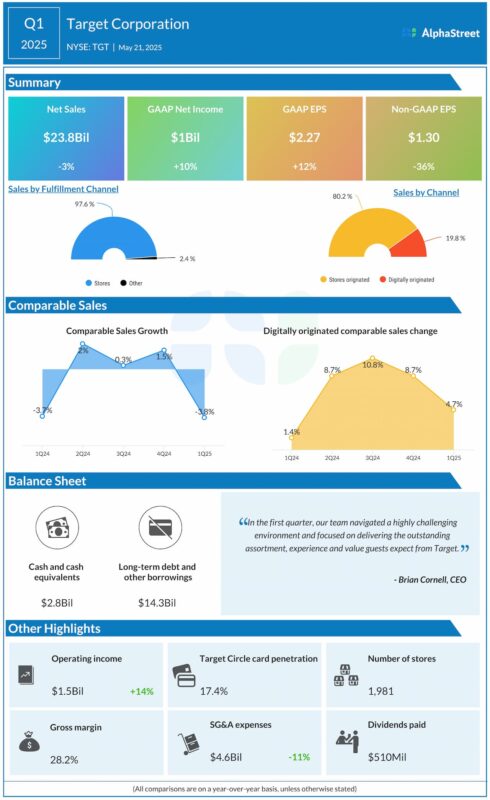

Hold onto your wallets! In the first quarter of fiscal 2025, Target’s sales DROPPED 2.8% to $23.8 billion. Even worse, they missed expectations again! The adjusted earnings? A gut-wrenching $1.30 per share, DOWN 36%! To add salt to the wound, comparable store sales spiraled down a shocking 5.7%, even as digital sales barely squeaked by with a 4.7% increase.

Two Strikes and You’re Out? Sweet Promises or Empty Words?

What’s worse is this marks TWO disappointing earnings reports in a row! The management’s hopeful guidance is now beginning to sound like a hollow echo, predicting a low-single-digit sales decline while eyeing unadjusted earnings of $8.00 to $10.00 per share. They’re adjusting their guidance for full-year earnings to a meager $7.00 to $9.00 per share.

Target’s Wobbly Strategy: Can It Survive?

Speaking at the Q1 earnings call, management claimed they’re committed to keeping prices competitive and supporting American families. But will this be enough to navigate through the stormy economic seas? They assure us they have the "vintage experience" in sourcing, but can this old playbook really stand the test of fierce competition from retail titans like Walmart and Costco?

Pressures Mounting: Inventory Woes and Customer Experience in Turmoil!

The challenges just keep piling on! Targets are wrestling with overwhelming inventory and cash flow issues! The lurking threat of new import tariffs has sent margins spiraling, compelling Target to diversify suppliers in a desperate scramble for survival. Their customer experience is deteriorating, and competition is hotter than ever!

As Tuesday’s trading clocked in just above $106, we’re left wondering: Is this the bottom? The stock ticked up slightly by 2.7%, but with the storm brewing, will it be enough to turn the ship around?

Stay tuned as this dramatic saga unfolds! Target’s future hangs in the balance!

[ad_2]