[adrotate group="2"]

DIAGEO: THE DRUNKEN GIANT IN FREEFALL!

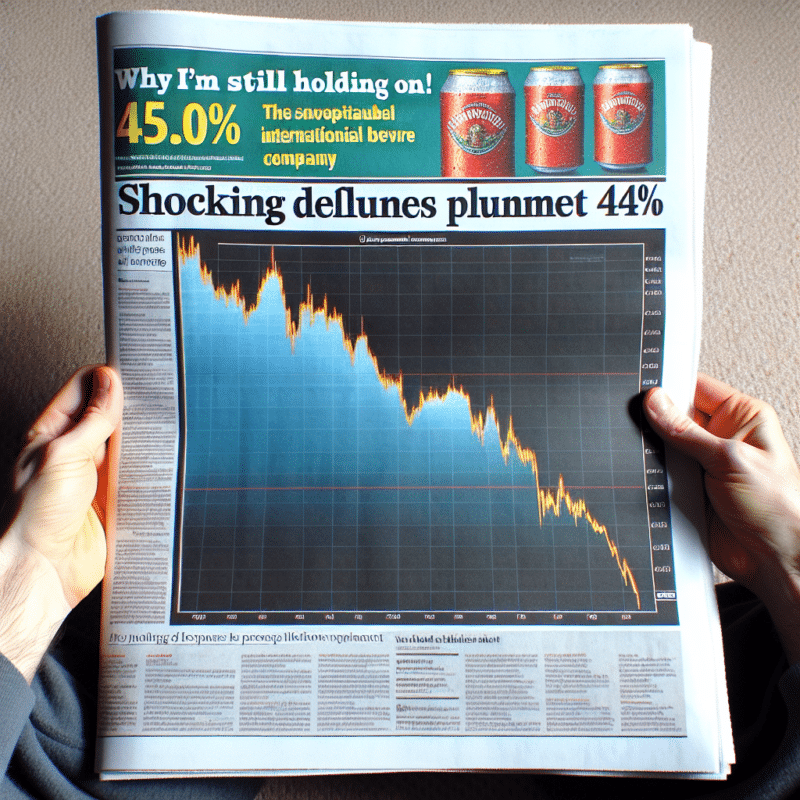

SHOCKING PLUNGE! Diageo Shares CRASH 43.8%!

Remember the wild, carefree days when Covid-19 lockdowns were just a distant memory? People hit the bars and partied like there was no tomorrow, propelling Diageo’s stock to record heights! But hold onto your cocktail glasses, folks – the party is OVER, and the hangover is REAL!

Diageo’s once-thriving stock has tanked, hitting the awful low of £22.69, a staggering 43.8% drop from its peak of £43.06 just two short years ago! Can you believe it? Investors are now shaking their heads in disbelief as this once-mighty FTSE 100 giant mirrors a sinking ship!

IT’S NOT JUST A FLUKE – THE NUMBERS DON’T LIE!

The numbers are downright terrifying! Over the last month, Diageo shares have plummeted 9.4%! In just one year, they’ve dropped 23.6%! And it gets worse – in five years, shareholders have lost a jaw-dropping 28.3% of their investment! These desperate days have led skeptics to label Diageo as a “VALUE TRAP” – a term used for stocks that seem like bargains but are really lead weights dragging down portfolios!

BLOODY SLOW SALES! What’s Happening?

The culprit behind this financial disaster? A shocking trend: adults are DRINKING LESS! Diageo has recently turned its back on its previous sales growth forecast of 5% to 7%, signaling a desperate fight to survive in a new marketplace where people are increasingly choosing health over hangovers! Yup, those trendy GLP-1 weight-loss drugs are taking a serious toll, and proposed US trade tariffs threaten to sink sales even further!

Beers might be doing okay, but demand for high-end spirits is slipping faster than your best friend’s drink at a party! With sales volume declining 0.2% over the last six months, this giant is feeling the heat, despite higher prices causing sales to nudge up by 1%. But wait – operating profits have fallen 1%, and profit margins are wavering!

THIS STOCK ISN’T A BARGAIN! OR IS IT?

On the surface, at £22.69, some might say this stock doesn’t seem that expensive. Trading at 17.6 times earnings with a 5.7% earnings yield, enthusiasts may argue it holds potential. But with a dividend yield of 3.6%, don’t get too excited! This financial rollercoaster seems far from over, and who knows when those dividends will start flowing like generous drinks again?

IS THERE HOPE FOR DIAGEO?

Despite the chaos, some still see an inkling of hope for Diageo’s future. If sales grow positively by 2025, this £50.5 billion behemoth could head toward calmer waters, alleviating its staggering $20.1 billion debt storm. But until then, expect slow and agonizing times for shareholders, sipping their way through this financial trainwreck!

In the thrilling world of stock market drama, Diageo’s fall from grace serves as a stark reminder: even the giants can stumble! Stay tuned, because this saga is far from over!

[adrotate group="2"]