[adrotate group="2"]

URGENT: Rent Shock! Americans are Losing Hours Just to Pay for Their Homes!

Hold onto your wallets, folks! 17 years ago, renting a place in America was a breeze, costing less than $1,000 a month. But NOW? The median rent has soared to over $1,300! That’s a staggering increase from just $824 in 2008. And guess what? Rents skyrocketed nearly 6% just between 2022 and 2025!

Americans Are Strapped! How Much of Your Paycheck Goes to Rent?

Many renters are pouring WAY more than a third of their take-home pay into housing—it’s a DISASTER caused by skyrocketing rent prices outpacing wage growth! You heard it right—people are grinding and sweating just to keep a roof over their heads.

Work ALL Month Just to Pay Rent? What Are We Doing?!

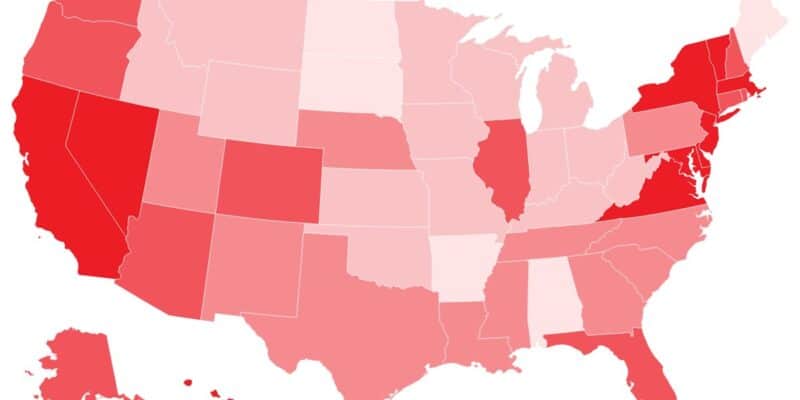

Get this: Americans are working an average of 38.3 hours a MONTH to cover rent—yes, that’s a whole work week just to pay those bills! But hold onto your hats; it varies wildly across the country.

The States Where Rent Is Utterly Crushing Your Wallet:

- Vermont: A jaw-dropping 60.2 hours!

- Hawaii: Close behind with 59.9 hours!

- California: A whopping 52.4 hours!

- New Jersey: Staggering 50.4 hours!

- Maryland: A torturous 50.3 hours!

The States Where Rent Is a Little Less Cruel:

- Maine: Still a tough 32.3 hours.

- North Dakota: Almost a miracle at 32.2 hours.

- Alabama: Bearing it with 31.4 hours.

- Arkansas: Scraping by at 31.1 hours.

- South Dakota: The “winner” at just 27.6 hours—but even that’s a lot!

Check out that horrifying heat map below—darker reds signal the hours you have to suffer just to pay rent!

A Dismal Picture… BUT Wait! A Glimmer of Hope?

Despite this grim reality, we might just see a spark of relief! As of May, rents dipped about 1% year-over-year! Crazy, right? Why? Because apartment construction is hitting a 50-year high! While the demand remains fierce, the supply is finally catching up, and renters may gain some negotiating power!

Renting Is STILL Cheaper Than Buying… For Now!

And hold your horses—mortgage rates are climbing up towards 7%, making buying a home nearly impossible for many! In Austin, Texas, renters can pay a monthly rent of $1,900 compared to a mind-blowing $3,200 mortgage payment for the same place. Renting may be your best bet unless you’ve got a hefty down payment stacked away!

So brace yourselves, America! The battle for affordable housing rages on, but maybe—just maybe—things are beginning to shift!

photo credit: fortune.com

[adrotate group="2"]