[adrotate group="2"]

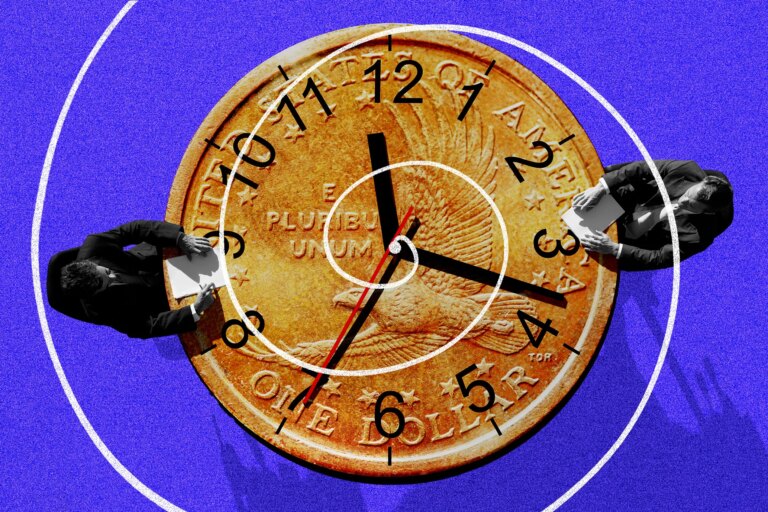

SHOCKING TURN OF EVENTS: Winklevoss Twins’ GEMINI ESCAPES SEC CLAWS!

Gemini Triumphs: The Undercover Battle With the SEC Ends After Nearly 700 Days!

In a jaw-dropping twist of fate, the Winklevoss twins have emerged victorious from the jaws of the U.S. Securities and Exchange Commission (SEC)! After an exhaustive inquiry lasting almost TWO YEARS, the SEC has finally waved the white flag and won’t be pursuing any enforcement action against Gemini!

Cameron Winklevoss broke the news himself, revealing that the SEC has officially shut the doors on its investigation—699 days after it kicked off and 277 days after a bombshell Wells Notice was dropped! That’s right, folks, nearly TWO YEARS of uncertainty now comes crashing to an end!

Unbelievable Allegations: What Sparked the SEC Rampage?

Back in January 2023, Gemini and Genesis Global Capital were thrown into a hotbed of drama with allegations surrounding the now-defunct Earn program. The SEC accused them of selling unregistered securities through a crypto lending scheme that imploded when Genesis halted withdrawals during the brutal 2022 bear market. It was chaos in the crypto world!

Victory Is Sweet, But the Battle Is Far From Over!

But wait, there’s a catch! While this might feel like a massive win, the SEC made it crystal clear—they’re not handing out gold stars just yet! This isn’t a formal exoneration, and the door is wide open for the agency to potentially strike again. Hold onto your hats, crypto enthusiasts, because the saga isn’t over!

Cameron Winklevoss has labeled this moment as a MILESTONE in the ongoing “war on crypto,” but he’s not sugar-coating the damage done. "Tens of millions of dollars in legal bills" have left scars that run deep in the crypto landscape, and the overall repercussions of the SEC’s heavy-handed tactics cannot be ignored.

Winklevoss Goes on the Offensive: ACCUSATIONS and DEMANDS!

Not one to hold back, Winklevoss went straight for the jugular, calling out the SEC’s actions that have led to “unquantifiable losses” in economic growth for America. He’s throwing down some serious suggestions for reform, demanding that companies entangled in regulatory battles should be reimbursed TRIPLE their legal costs if an agency can’t lay down clear rules prior to an investigation.

AND, he’s not stopping there! He’s advocating for a “dishonorable discharge” policy that would PUBLICLY expose SEC officials who pursue what he deems baseless charges. Names and roles would be displayed for the world to see on the SEC’s website—talk about a scandal!

SEC’s BULLDOZER: Under Gensler, the Agency MERCILESSLY CRUSHED The Crypto Industry!

Under the reign of Gary Gensler, the SEC turned into a bulldozer, unleashing over 100 enforcement actions since 2021 against big names like Coinbase, Binance, Ripple, and Kraken, branding them as unregistered securities platforms. This wave of “regulation by enforcement” has left a trail of legal chaos that’s fundamentally reshaped the landscape of crypto.

But hold onto your hats! With Gensler’s exit in January, the SEC seems to be easing off the gas pedal. Just this past February, they wrapped up investigations into major players like Coinbase, OpenSea, Uniswap Labs, and Robinhood Crypto—the tide might just be turning!

THE FINAL WORD: The Battle Rages On!

While Gemini escapes the SEC’s clutches for now, the battle for crypto freedom is far from over. Stay tuned, because the future of the crypto industry hangs in the balance!

[adrotate group="2"]