[adrotate group="2"]

JAW-DROPPING PROFITS: MICRON SET TO BREAK RECORDS WITH HBM SALES!

In an electrifying twist, Micron Technology (NASDAQ: MU) is striding into its third quarter with a mind-blowing forecast that promises record-high revenues! Buckle up, folks! This chip giant is turbocharging its way through the tech stratosphere, harnessing the power of high-bandwidth memory (HBM) and AI-driven solutions that have investors buzzing with excitement.

UNSTOPPABLE GROWTH! Micron Smashes Q2 Earnings Expectations!

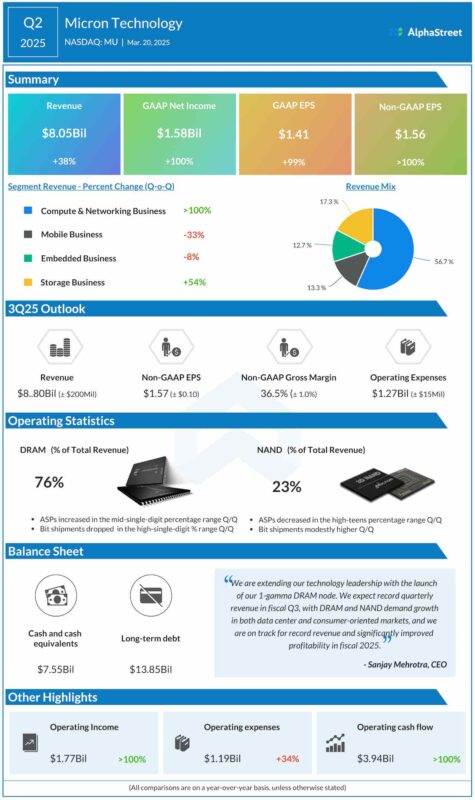

Let’s break it down: Micron’s adjusted earnings soared to an astonishing $1.56 per share, up from a mere $0.42 last year, leaving Wall Street analysts gasping in disbelief! The company reported a net income of $1.58 billion, rocketing from just $793 million last year. How’s that for a comeback? Revenues skyrocketed to $8.1 billion from $5.82 billion! Micron is absolutely dominating the data center DRAM market and has now beaten estimates for an incredible EIGHT straight quarters!

CEO SPILLS THE TEA: "WE’RE LEADING THE PACK!"

Micron’s fearless leader, CEO Sanjay Mehrotra, took the stage and proclaimed, “We are the only company in the universe shipping low-power DRAM into data centers at such a high volume!” Can you say game-changer? As demand for AI data center solutions soars, Micron expects Q3 revenues to BEAT RECORDS once again, with lofty forecasted revenues climbing to an eye-popping $8.8 billion.

But hold on—before you start planning that victory parade, a cloud looms on the horizon! Micron warns of a drop in profit margins for the next quarter, projecting gross margins will dip to about 36.5%. The market took a hit, with shares plunging after-hours as investor enthusiasm flickered.

CHALLENGES AHEAD: CAN MICRON MAINTAIN MOMENTUM?

Despite a stormy spell that saw shares tumble about 15% over the past year, Micron is hell-bent on expanding its high-bandwidth capacity to stay ahead in the fast-paced tech race. With projected operating expenses of around $1.13 billion for Q3 and a significant 10% spike expected in FY25, Micron is investing in a technology revolution to keep those profit engines roaring!

IN THE LINE OF FIRE: WILL INVESTORS PULL THE TRIGGER?

After an early-session plunge of 8% on Friday, uncertainty hangs in the air. But with Micron’s unique positioning to capitalize on surging demand for HBM chips, the question remains: will they overcome these challenges and soar back to glory? The countdown to Q3 is on! Keep your eyes peeled, folks—this adventure is far from over!

[adrotate group="2"]