[adrotate group="2"]

Reflecting on 2024, the groundwork laid by Meta’s executives in the previous year focused on flattening management structures to enhance agility and implementing cost-cutting measures to boost profitability. This strategy bore fruit — witnessing a 156% rise in operating margin by the end of 2023 (the fourth quarter was disclosed on February 1), alongside an over 20 percentage point increase in operating margin. Additionally, Meta made a significant move by announcing its inaugural dividend, signaling CEO Mark Zuckerberg’s confidence in sustained profitable growth and cash generation.

However, the stock’s journey wasn’t linear; it faced some turbulence as investors expressed concerns over Meta’s fiscal 2024 second-quarter revenue guidance and an upward adjustment to full-year capital expenditures. These issues became apparent alongside the first-quarter earnings report after the market closed on April 24, resulting in a 10.5% decline in shares the following day. Nevertheless, as we previously observed in our analysis of that Q1 report, this pullback presented a buying opportunity.

As the calendar advanced, Meta’s shares regained momentum as the market began to recognize the company’s substantial user data assets, positioning it as a formidable contender in the realm of generative artificial intelligence. Meta has effectively utilized AI to deliver improved contextual content and advertising, and it has introduced new AI creation tools for companies to develop their own advertisements.

Looking ahead to 2025, we are optimistic that the management will remain committed to its efficiency goals while also investing heavily in AI and continuing innovations within Reality Labs, the division responsible for metaverse projects and virtual reality headsets. Though sustained losses in Reality Labs are anticipated in the near term, we believe the market will be accommodating as long as these losses are managed and profitability and cash flow are prioritized. After all, without substantial investments in groundbreaking projects, we wouldn’t see innovations like Meta’s Ray-Ban connected glasses, which may not contribute significantly to revenue but hold promise, especially following Zuckerberg’s preview of the Orion augmented reality prototype.

As Meta expands its advertising tools for sellers and develops new user engagement strategies, we anticipate an increase in average revenue per user (ARPU). Key to this will be better monetization of WhatsApp and Messenger and encouraging user growth in Threads, the latest addition to Meta’s Family of Apps ecosystem, designed as a competitor to X, formerly known as Twitter. Furthermore, enhancing the capabilities of the company’s large language model, Llama, will be crucial for strengthening core business functions and unlocking new revenue streams for both consumers and business clients.

Regulatory risks are ever-present for social media entities, particularly for a company with the scale of Meta. The evolving political landscape, especially considering President-elect Donald Trump’s views on Big Tech, adds another layer of uncertainty. Trump has previously taken aim at Meta and other tech entities over perceived biases against conservative voices, while Zuckerberg and other tech leaders appear to have aligned with Trump post-election.

Additionally, a Supreme Court hearing on January 10 will assess the legality of a TikTok divestment law, mere days before the deadline for ByteDance to divest its interests in TikTok to avert a U.S. ban, coinciding closely with Trump’s inauguration. A potential ban on TikTok would positively impact Meta’s short-form video platform, Reels. Despite our belief that the management is earnest in its commitment to cost management and simplification, investments in AI and Reality Labs initiatives represent a risk. Wall Street remains wary of losing focus on profitability. (Note: Jim Cramer’s Charitable Trust holds a long position in META; more details can be found in the full stock listing.) As a subscriber to the CNBC Investing Club led by Jim Cramer, you’ll receive trade alerts prior to any transactions he executes, with specific waiting periods before any trading takes place. All club information adheres to our Terms and Conditions, Privacy Policy, and disclaimers. No fiduciary obligation is created through the receipt of any information related to the Investing Club, and no specific outcomes or profits are guaranteed.

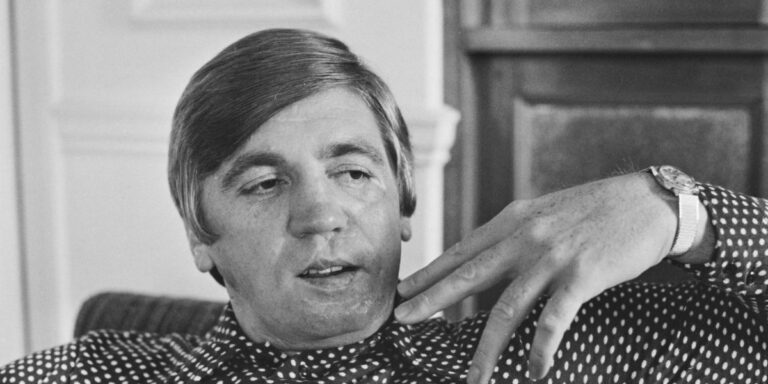

At the Meta Connect developer conference, Mark Zuckerberg, the head of Meta, reveals the prototype of computer glasses that can display digital objects through transparent lenses.

Andrej Sokolow | Picture Alliance | Getty Images

What a remarkable turnaround.

Meta Platforms has maintained its upward momentum this year, building on the successes of 2023, which Wall Street has dubbed the “year of efficiency.”

Political factors present significant uncertainty for 2025.