[adrotate group="2"]

TARIFF TORNADO! Is Trump Unleashing Economic Chaos?

Hold onto your wallets, folks! President Donald Trump has sent shockwaves through the financial world, rolling out a staggering 25% tariff on imported vehicles and car parts! Auto stocks took a nosedive, sending investors into a frenzy, but the S&P 500 is surprisingly holding strong—so what’s really going on?

TRUMP’S TRADE WAR: Are We Staring Down the Barrel of a Global Crisis?

In a bold move dubbed “Liberation Day,” Trump is back with a vengeance, hinting at serious tariff increases that could spark pandemonium among U.S. trading partners! Morgan Stanley’s investment wizard, Jim Caron, dropped a bombshell by saying traders are now ready to handle whatever curveballs come their way. But can they survive this economic storm?

Market Mayhem: How Will Your Portfolio Survive?

Investors are still reeling from the sharp turns of Trump’s tariff threats, which knocked the S&P 500 down 10% just last month. While the auto industry trembles, other sectors may rise like a phoenix! The volatility versus uncertainty game is heating up. Forget the chaos—Caron reassures us that financial markets have the tools to "manage volatility." But is that enough?

Doom and Gloom: Goldman Sachs Slices Growth Predictions!

Just when you thought it couldn’t get worse, Goldman Sachs slashed U.S. GDP growth estimates from 2.4% to a shocking 1.7%! Are we heading for an economic winter? The Fed’s Jerome Powell warns that any price hikes may only be the tip of the iceberg! This rollercoaster isn’t slowing down any time soon!

The Great American Dream Shattered?

With the S&P 500 down nearly 3% already this year, savvy investors are eyeing greener pastures abroad. Stocks across Europe are skyrocketing as countries prepare to boost spending, leaving U.S. traders questioning the fate of the once-fabled “American exceptionalism.” The European STOXX 600 is up 7% and the DAX has skyrocketed 12% due to fears of U.S. abandonment. Are we witnessing the beginning of the end for American dominance?

China’s Stock Market Shines Amid Tariff Tensions!

Despite Trump’s aggressive tariff hikes, the S&P China 50 Index has defied expectations, soaring 16%! What’s behind this miracle? Investors are pumped about China’s tech and AI advancements, thanks to the surprise success of the revolutionary DeepSeek’s R1 model. Meanwhile, Bank of America reports a MASSIVE drop in U.S. equity allocations—69% of fund managers say “American exceptionalism” is on its last legs!

Investor Caution in a World of Uncertainty!

While some see opportunity, others, like Hightower Advisors’ Stephanie Link, are treading carefully. She’s skeptical about European stocks burdened by heavy regulations and even more wary of China, where the mysterious disappearance of Alibaba’s Jack Ma raises red flags! Where should investors park their hard-earned cash?

Are You Ready to Diversify?

With the S&P 500 trading at a whopping 22 times forward earnings, savvy investors are searching for alternatives, and some are even eyeing India as a fresh new frontier! Dive into diversification, but will it be enough to shield you from Trump’s tariff havoc?

FINAL TAKEAWAY: The Tariff Picture is Clearing—Or is it?

As uncertainties loom larger than ever, some investors cling to a small glimmer of hope that the tariff picture is slowly coming into focus. But can we really trust the stability of the markets in the face of such chaos? Buckle up, folks—this financial rollercoaster is far from over!

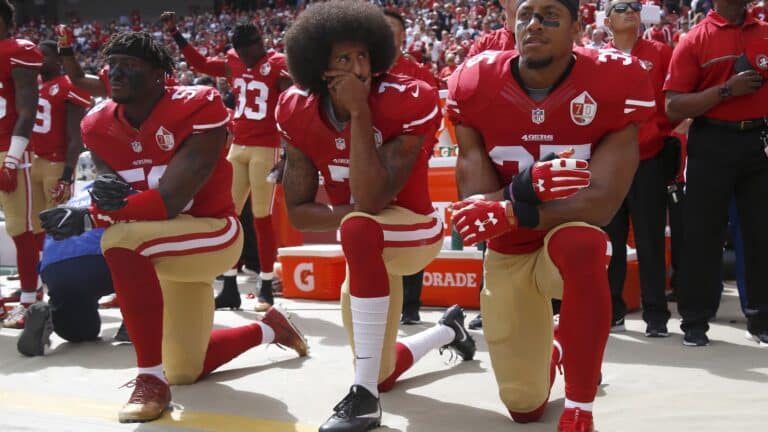

photo credit: fortune.com

[adrotate group="2"]