[adrotate group="2"]

Lennar Survives the Storm! Homebuilder’s Bold Moves Amid Economic Chaos!

Stock Surge! Lennar (LEN) Defies Odds as Shares Rise Over 1% Despite 11% Decline!

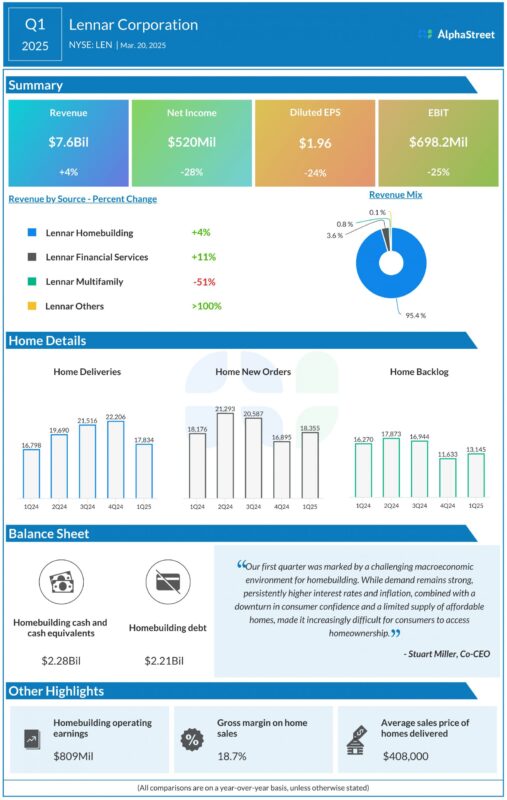

In a jaw-dropping twist, Lennar Corporation (NYSE: LEN) has snagged a surprise win! On Monday, shares perked up over 1% after a turbulent three months! The homebuilding titan has reported explosive revenue growth despite profits taking a nosedive in an economic ozone of uncertainty. Buckle up as we reveal how Lennar is weathering these turbulent times!

Housing Market Crisis: Higher Rates & Job Fears Crush Affordability!

The housing market is in a tailspin! With sky-high mortgage rates and inflation shooting through the roof, homebuyers are paralyzed by affordability woes! Although demand is electric, buyers are trapped in a financial chokehold, struggling to scrape together down payments or qualify for loans. As if that’s not enough, fresh job security anxieties are twisting the knife deeper!

To make matters worse, the already shrinking supply of homes is set to plummet further! Years of sluggish production mixed with prohibitive construction costs and bureaucratic land regulations are creating a perfect storm! To top this mess off, looming immigration policies and tariffs are throwing even more curveballs!

And just when you thought it couldn’t get worse, housing prices are beginning to tumble!

Lennar’s Daring Game Plan: Staying Afloat with Innovation!

In a bold step, Lennar’s strategy aims to cut through the chaos! On their latest quarterly conference call, they laid bare a two-pronged approach to swim against the current: maximize efficiency and embrace an asset-light business model!

Lennar is laser-focused on keeping production and sales aligned like a well-oiled machine! Whether the skies are sunny or stormy, they’re committed to delivering steady volumes across all divisions and communities! This could spell major savings from construction costs and help dodge the dreaded inventory pitfalls!

Meanwhile, Lennar’s sassy asset-light, land-light manufacturing model is all about just-in-time home developments that promise lower risks and predictable growth. It’s an audacious gamble that could revolutionize their cost structure!

Q1 Shockwave: Revenue Up, Earnings Down!

In an electrifying Q1 2025 performance, Lennar’s total revenue skyrocketed by 4% year-over-year to a staggering $7.6 billion! But, hold onto your hats—adjusted earnings took a hit, plummeting 17% to $2.14 per share! New orders crept up by 1%, totaling 18,355 homes, while deliveries jumped 6% to 17,834 homes! But here’s the kicker: the average sales price slipped by 1% to $408,000, revealing the grim realities of a struggling market! Gross margins? A dreadful fall to 18.7% from 21.8%!

What’s Next? The Tension Mounts for Q2 2025!

As tension mounts for the second quarter, Lennar is projecting new orders between 22,500-23,500 and deliveries of 19,500-20,500. The average sales price is expected to stumble to between $390,000-400,000! Will they salvage a gross margin around 18%? And can EPS bounce back to $1.80-2.00? The stakes have never been higher!

Stay tuned, folks! The Lennar saga is heating up, and you won’t want to miss a moment of this wild ride!

[adrotate group="2"]