[adrotate group="2"]

Johnson & Johnson (NYSE: JNJ) is anticipated to release its earnings report for the December quarter on January 22, with expectations of mixed results. In recent years, the company has navigated various challenges while leveraging opportunities in its expansive drug pipeline and new product launches to ensure growth beyond 2025.

In the previous year, the stock of the healthcare behemoth exhibited significant volatility, characterized by fluctuations. Currently, the stock’s price is similar to its value nearly four years prior. Despite this, JNJ has consistently rewarded shareholders with regular dividend increases throughout the years, currently offering a yield of 3.4%, notably higher than the S&P 500 average.

Upcoming Q4 Results

Johnson & Johnson’s fourth-quarter results are set to be announced on Wednesday, January 22, at 6:20 am ET. Analysts on Wall Street project a 5% rise in revenues, reaching $22.45 billion in Q4. However, the company’s adjusted earnings are expected to decrease to $2.04 per share for the final months of the fiscal year, down from $2.29 per share in Q4 2023.

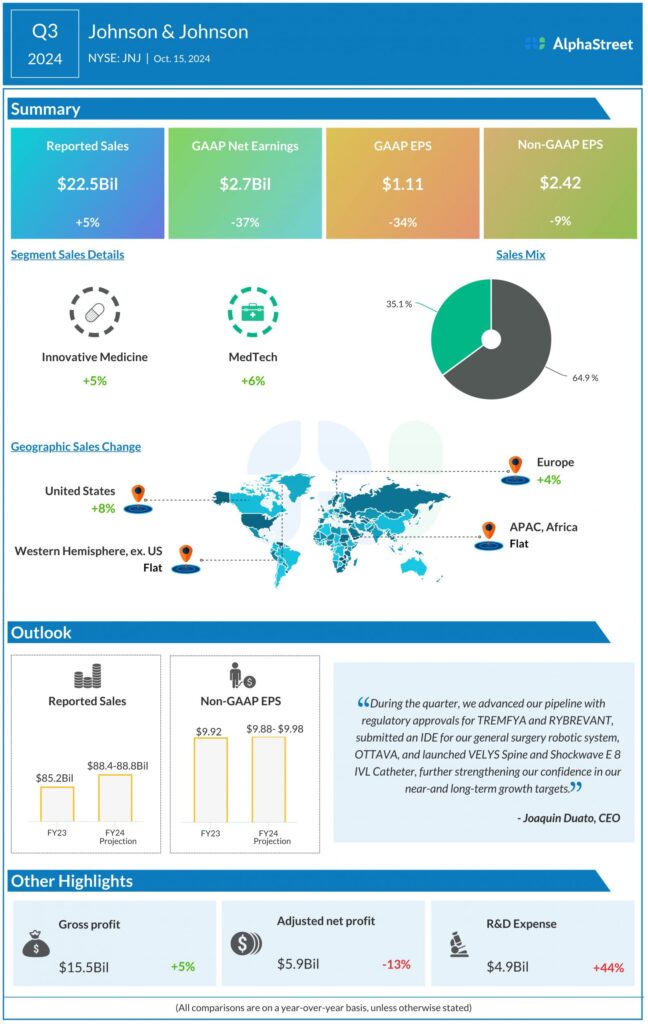

Insights from Johnson & Johnson’s Q3 2024 earnings call:

“Our performance reflects the unique breadth of our business and our dedication to providing the next wave of healthcare innovation to patients globally. Additionally, it highlights our efforts to pivot our pipeline and portfolio toward high-innovation and high-growth markets. This includes our recent acquisitions of Shockwave and V-Wave in med tech, as well as Ambrx, Proteologix, and the NM26 bispecific antibody in innovative medicine.”

Last year, stable sales in the US and Europe compensated for weaknesses in Asian markets like China and Japan due to an economic slowdown. Healthy cash flows have allowed the drugmaker to ramp up R&D spending, reaching $5 billion in the third quarter alone. However, ongoing legal challenges concerning product safety and related settlements are expected to adversely affect the company’s finances in the near term.

Surpassing Expectations

For over a decade, Johnson & Johnson has consistently exceeded Wall Street’s quarterly earnings estimates. In the most recent quarter, both revenue and profit surpassed expectations, with third-quarter sales increasing by 5% year-over-year to $22.5 billion, driven by 5% and 6% growth in the Innovative Medicine and MedTech sectors, respectively.

Meanwhile, adjusted earnings fell by 9% year-over-year to $2.42 per share. For the entire FY24, the company expects sales to range between $88.4 billion and $88.8 billion, with adjusted earnings expected to be between $9.88 and $9.98 per share. Notably, net income on a reported basis declined significantly, falling to $2.7 billion or $1.11 per share.

In Expansion Mode

This week, Johnson & Johnson announced its acquisition of Intra-Cellular Therapies, a biopharmaceutical firm focused on therapeutics for central nervous system disorders, for approximately $14.6 billion. This acquisition follows a series of recent purchases, including Shockwave Medical, a heart device manufacturer, and V-Wave, which specializes in heart failure treatments.

JNJ has been trading below its 52-week average price for over a month, with the stock showing declines during early trading on Wednesday.