[adrotate group="2"]

- Gold prices exhibited considerable volatility on Monday, fluctuating between 2650 and 2614 before closing at 2635, influenced by changes in the US Dollar and tariff-related news.

- Attention will focus on the upcoming US Services PMI data; a strong figure could bolster the US dollar and negatively impact gold prices.

- From a technical perspective, gold seems set for another upward move, although prevailing economic factors may limit its gains.

Gold prices experienced substantial fluctuations on Monday, marking the start of the week with prominent price changes. The metal peaked at approximately 2650 during the session, fell to a low of around 2614, and ultimately concluded the day at 2635.

This erratic behavior was closely linked to the movements of the US Dollar. Initially, the Dollar weakened after a Washington Post article hinted at potential universal tariffs, negatively affecting the currency. However, President Trump later dismissed the report as inaccurate, allowing the greenback to regain some strength temporarily.

This series of developments highlighted how sensitive gold prices are to tariff-related news and potential policy changes from the Trump administration.

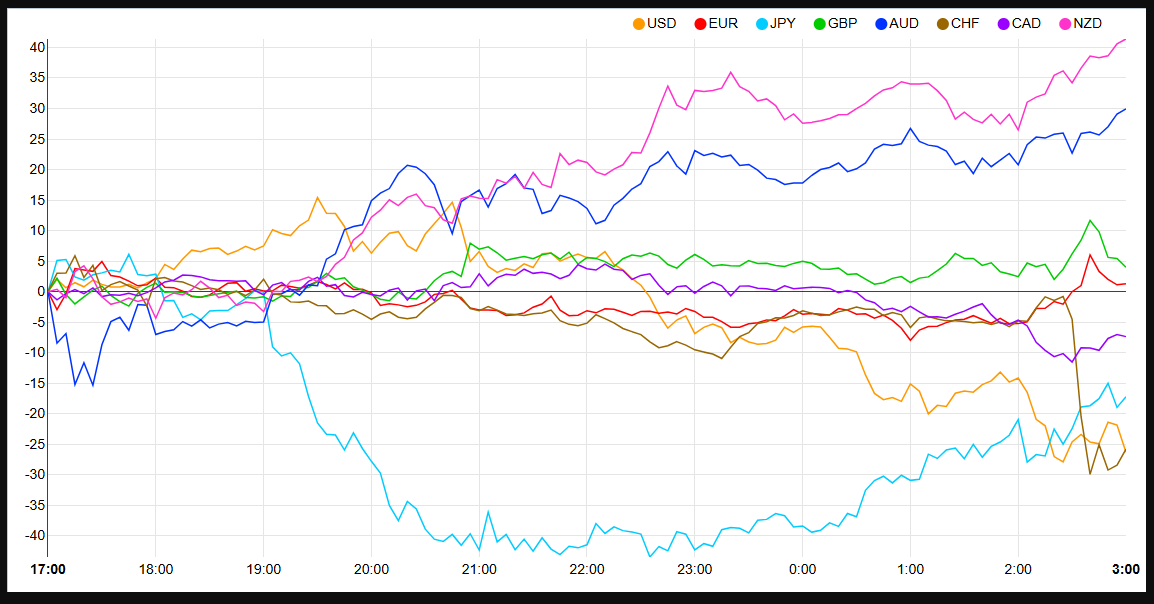

In early European trading, the US Dollar continued to face selling pressure, as reflected in the currency strength chart below.

Currency Strength Chart: Strongest – NZD, AUD, GBP, EUR, CAD, JPY, CHF, USD – Weakest

Source: FinancialJuice

Will Trade War Concerns Support Gold Prices?

As we look ahead to the week, gold finds itself in a fascinating position. There is a clear tug-of-war between bullish and bearish sentiment, with fears of a trade war likely providing some support for the precious metal. Conversely, expectations for a tighter US monetary policy and fewer rate cuts could pose challenges for gold prices.

This dynamic means that news relating to tariffs and policy developments will significantly influence gold prices. Additionally, any adjustments to rate-cut expectations will play a similar role.

Since Donald Trump’s election victory, the optimistic outlook for gold by 2025 has been notably tempered. This is further illustrated by Goldman Sachs, which has revised its 2025 gold price target down from $3000/oz, citing expectations of stricter US monetary policy.

However, dismissing the possibility of reaching $3000/oz entirely might be premature. The ongoing delicate geopolitical climate and rising global risks—such as the potential for further conflict in the Middle East or developments in the Russia-Ukraine situation—could bring about such a price point.

Another potential area of support could be central bank purchases. The year 2024 saw significant gold buying from numerous central banks, as evidenced by the monthly gold report from August, with expectations for continued buying into 2025.

The Week Ahead

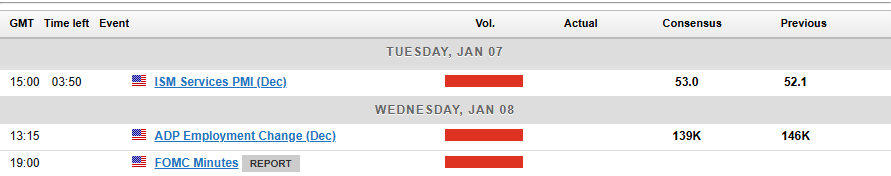

Today, we are awaiting important US data, particularly significant given the service-oriented nature of the US economy.

Last week, the data (insert relevant data) registered at 49.3, outperforming the anticipated figure of 48.2 by 1.1 points, indicating growth in the US manufacturing sector and underscoring economic strength.

A stronger-than-expected US Services PMI reading could exert pressure on gold prices by strengthening the US dollar.

Technical Analysis for Gold (XAU/USD)

From a technical perspective, the analysis follows up on last week’s technical insights. Read:

Gold appears positioned for another upward movement based on the recent daily price action.

The precious metal has been printing higher highs and higher lows since the December 19 low of 2582. Yesterday’s daily candle formed a long wick at the bottom while preserving the overall bullish structure, setting the stage for a potential further rise.

However, prevailing economic fundamentals may limit these gains, with much depending on US data released later in the day.

Immediate resistance is evident at yesterday’s high of 2650, followed by the 2664 and 2674 levels.

If prices move downward today, they might find support at 2624 or yesterday’s lows around 2614. A breach of these levels could lead to a renewed test of the 2600 mark.

Gold (XAU/USD) Daily Chart, January 7, 2025

Source: TradingView

Support

Resistance

Most Read:

Original Post

[adrotate group="2"]