[adrotate group="2"]

Image source: Getty Images

The UK stock market, as indicated by the FTSE All-Share Index, has seen a solid performance in 2024, with a year-to-date increase of 7.5%, surpassing the five-year average return of 5.7%.

Other markets, however, have outperformed this index. For instance, the S&P 500, driven by tech giants commonly referred to as the Magnificent 7, has surged by nearly 27% this year. Ironically, the comparatively lower reliance on tech stocks is one of four reasons I believe the FTSE will thrive in 2025.

1. Back in fashion

US stocks are currently valued at a staggering 2.08 times their GDP (in the UK, the ratio is 1.08).

According to IG, the cyclically adjusted price-to-earnings ratio (CAPE) stands at 31.1 for US stocks, compared to 18.6 for the UK.

However, tech stocks account for just 1% of the movement in the FTSE All-Share Index. As valuations soar in the tech sector, traditional sectors such as energy, mining, and banking — which are heavily represented in the FTSE 100 — may benefit.

For example, Lloyds Banking Group (LSE:LLOY) is among the highest-yielding stocks in the index.

For the 2024 financial year, the bank is poised to distribute a dividend of 3.18p per share, translating to a yield of 5.8%, which is well above the FTSE average of 3.8%.

While dividends are not guaranteed, the bank’s performance in the first three quarters of 2024 suggests a reasonably secure payout, as it exceeded analysts’ revenue and profit expectations.

Nonetheless, an ongoing investigation into potential mis-selling of car finance is currently weighing on the bank’s share price.

In my opinion, even the most pessimistic outcomes will have minimal impact on Lloyds, which reported over £900 billion in assets on its balance sheet as of September 30, 2024, including £59 billion in cash and equivalents.

Although I maintain a positive outlook, investor sentiment appears anxious, prompting me to hold off on investment decisions until the situation becomes clearer. I’m also wary of the competition posed by ‘challenger banks.’

2. Dividends galore

Notably, Lloyds is just one among many dividend-paying stocks available.

Over the past decade, the FTSE All-Share Index has delivered a yield of 4%, in contrast to the 2% yield of the S&P 500. Factoring in share buybacks, the cash yield for UK equities rises to 6%.

This dividend landscape should contribute to the uplift of the domestic market in 2025 and possibly explain the resurgence of cash investments.

3. Loads of money

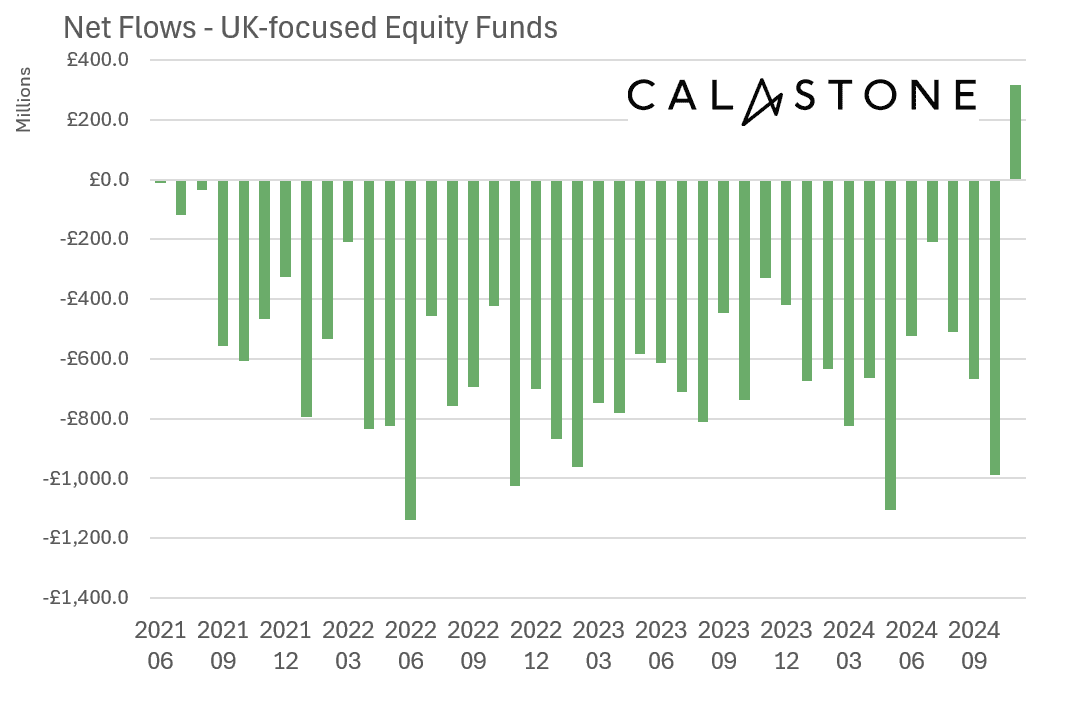

According to data from Calastone, there has been a notable net inflow into UK-focused equity funds for the first time since May 2021, marking a pivotal turn in investor sentiment.

I believe this trend strongly indicates that investors perceive the UK stock market as undervalued compared to its counterparts.

4. Return to growth

Additionally, I am positive about the recent upgrade to the OECD’s growth forecast for the UK in 2025, adjusting from 1.2% to 1.7%.

With the Bank of England’s Governor hinting at potential interest rate cuts next year, both consumer and investor confidence should improve, allowing for increased disposable income to be funneled into investments.

As a significant portion of my investment portfolio is in UK equities, I hope that my optimism for 2025 resonates with other investors as well!