[adrotate group="2"]

Dollar Tree’s Shocking Stock Plunge! 🚨 What You Need to Know!

Dollar Tree’s Earnings Report Sends Shares Spiraling Downward!

In a jaw-dropping twist, Dollar Tree, Inc. (NASDAQ: DLTR) shares plummeted 6% on Wednesday, leaving investors on the edge of their seats! Despite shattering revenue and earnings expectations for Q1 2025, a dark cloud looms overhead. Tariffs and looming pressures are raising alarm bells, overshadowing the company’s apparent financial triumph!

Earnings Beat That Still Hurts! 💔

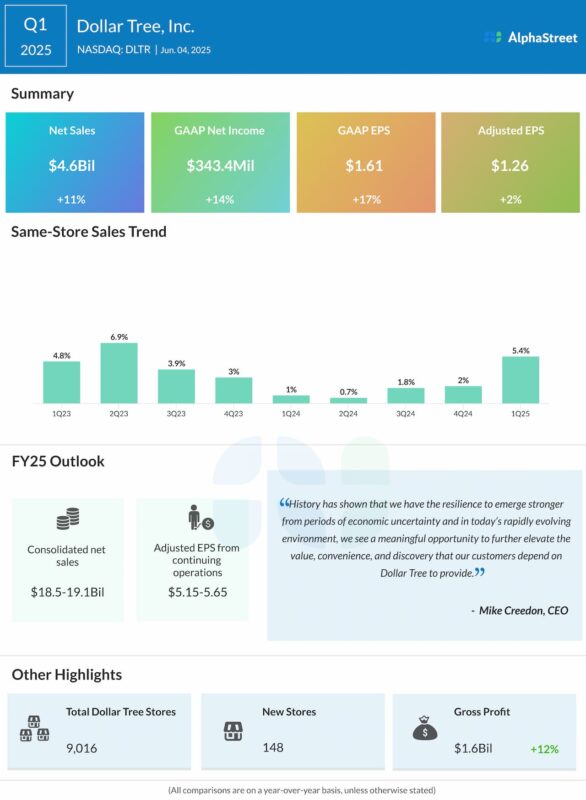

Hold onto your wallets! Dollar Tree’s net sales skyrocketed a staggering 11.3% year-over-year to a jaw-dropping $4.6 billion, blasting past the $4.5 billion mark like a rocket! Earnings per share surged 17% to $1.61 compared to last year, with adjusted EPS rising 2.4% to $1.26—far exceeding the $1.20 predictions! So why the panic?

Sales Surge, But What’s the Catch? ⚠️

While the numbers shatter expectations, Dollar Tree reveals a complicated fate. Same-store sales jumped 5.4%, with consumers flocking to the stores—seemingly good news, right? Here’s the kicker: the November doom and gloom thoughts hang over future earnings like a dark storm cloud. The consumables category enjoyed a 6.4% boost, while discretionary items weren’t far behind with a 4.6% uptick.

Despite lower freight costs and more, a mixed bag of issues like rising distribution costs and markdowns gnaw at profit margins, leaving experts questioning the company’s stability!

Store Openings and Transformations! 🚀

In an ambitious move, Dollar Tree opened 148 brand new stores and transformed around 500 locations into its eye-popping 3.0 multi-price format. With over 9,000 locations, these new stores have seen explosive traffic and ticket sales, generating hope amid the storm!

And there’s more! Dollar Tree is selling its Family Dollar business for a whopping $1 billion! With around $800 million in net proceeds on the horizon, it’s a strategic play to keep the company afloat as stormy seas rage on!

A Cautious Future Ahead! 🌪️

Looking forward, the retailer projects net sales for fiscal year 2025 to reach a head-spinning $18.5-19.1 billion but warns of a 3-5% growth in comparable sales that might leave investors gasping. They’ve even raised their adjusted EPS outlook to $5.15-5.65 from the previous $5.00-5.50—but will it be enough to calm the storm brewing?

As bleak clouds loom, the expected adjusted EPS for Q2 could plummet by a shocking 45-50% year-over-year! Yet solace could return in Q3 and Q4, as the company hopes to recover lost ground.

Stay tuned, folks! The plot thickens as Dollar Tree navigates a rollercoaster of profits, stores, and volatile earnings!

[adrotate group="2"]