[adrotate group="2"]

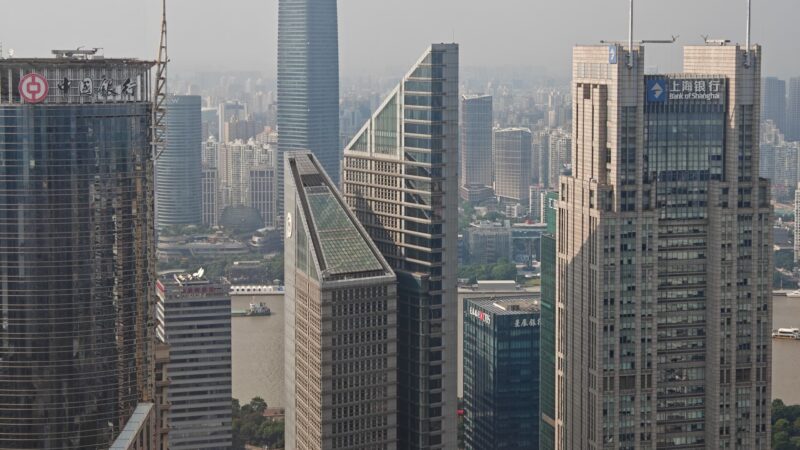

CHINA’S STOCK MARKETS ON A TEETER-TOTTER: DARE YOU RISK IT?

Brace for Impact: A Shockwave of Market Turmoil Is Coming!

Hold onto your wallets, folks! Experts from Morgan Stanley are sounding the alarm bells, warning investors to tighten their belts as the second half of the year approaches. The masterminds behind the latest market analysis are predicting an impending SURGE OF VOLATILITY that could leave portfolios in shambles!

Chinese Stocks Stumble: A Shares in Decline!

In a shocking twist, sentiment around mainland Chinese stocks, clumsily dubbed "A Shares," has plummeted this week. Why? Chinese policymakers have been totally M.I.A. when it comes to LOADS OF GROWTH that investors desperately crave. As we gear up for a Politburo meeting later this month, there’s NO GOOD NEWS in sight. The clock is ticking on U.S. trade agreements, too—mark your calendars for July 9, folks, because the 90-DAY TARIFF TRUCE is set to END in mid-August!

Dividend Dreams: Clutch Those Cash Cows!

In the midst of this storm, Morgan Stanley’s Laura Wang is urging stockholders to seek refuge in DIVIDEND YIELD PLAYS! What’s the hot tip? Look no further than the China-listed insurer, PICC P&C, flaunting a FANCY 4.5% DIVIDEND YIELD and teetering on the brink of benefiting from auto insurance growth. Pop Mart, the maker of adorable Labubu toys, took a hit as it was replaced on the focus list! Ouch!

High-Yield Hopes: Investors Seeking Safe Havens!

UBS’s Lei Meng is also putting the spotlight on high-dividend stocks as investors batten down the hatches. Banks and high-dividend stocks are in vogue, enjoying the support of state-backed buying amid rising uncertainties. But hold your horses—Meng predicts that inflows into tech will hit the brakes after a robust first half.

WILD MARKET PERFORMANCE: The Good, the Bad, and the Ugly!

In the ongoing stock saga, two worlds collide: Hong Kong’s Hang Seng Index, boasting tech giants like Alibaba and Tencent, soared nearly 20% in the first half! Meanwhile, the Shanghai Composite, laden with state-owned businesses, limped along with a measly 3% RISE.

Investor Shenanigans: High-Yield Stocks in Demand!

What’s causing this frenzy for high-yield stocks? Mainland investors, eager for better returns than what their home turf can dish out, are flocking to stocks like PetroChina offering a jaw-dropping 7.3% YIELD and CR Power at 6.1%! But beware, folks! These same investors are facing tougher restrictions reaching U.S. markets.

Global Views: U.S. Stocks Rule the Roost!

Over in the global arena, institutional investors still see the U.S. as the least risky playground, while exploring Europe, China, and emerging markets for a little spice. The unattractive stocks—like utilities? According to WisdomTree’s Liqian Ren: “Not where they’ll park cash!”

Get ready for a wild ride, and make sure you’re holding tight to those dividends because the rollercoaster is just beginning—who knows where it’ll end!

[adrotate group="2"]