[adrotate group="2"]

EXPLOSIVE INTERVENTIONS: CENTRAL HUIJIN GOES ALL-IN FOR CHINA’S FINANCIAL FUTURE!

Hold on to your wallets, folks! Central Huijin, the powerhouse arm of China’s sovereign wealth fund, has just kicked it into overdrive, transforming itself into a financial juggernaut over the past year. Forget quiet investments; this is a full-blown rescue mission for the nation’s economy!

CENTRAL HUIJIN UNLEASHES A WHOPPING $140 BILLION!

In a jaw-dropping move, Central Huijin has catapulted its exchange-traded fund (ETF) holdings to an eye-popping Rmb1 trillion (that’s $140 billion, baby!) in 2024—up a staggering sevenfold compared to last year! With the government issuing stimulus measures left and right, this bank-bailing behemoth is making waves like never before.

BEIJING’S FINANCIAL POWERHOUSE: READY FOR A THROWDOWN!

Beijing is revving up its plans to create mega financial institutions to tackle an economy in crisis. Enter Central Huijin, the ultimate player on the state team, ready to dive into the fray! Pledging its unwavering support for the market during escalating trade wars, Huijin’s bold, banner-waving declaration as part of the “national team” is shaking things to their core!

“IT’S THE BIG ONE!” EXPERTS SAY HUIJIN IS JUST GETTING STARTED!

Experts are ringing alarm bells! “Central Huijin is obviously being asked to play a big role,” warns researcher George Magnus from Oxford. With non-performing loans skyrocketing, tighter credit suffocating borrowers, and weak asset prices hanging over the market like a dark cloud, Huijin is now more crucial than ever!

A CONTROL FREAK’S DREAM: THE STATE’S SECRET WEAPON!

Kept largely under wraps, this financial behemoth has been the government’s secret weapon since it burst onto the scene in 2003. From performing Houdini-style rescues of regional banks to being a major player in tight financial situations, Huijin holds controlling stakes in major players like ICBC and China Everbright. The stakes couldn’t be higher!

STRATEGIC OVERHAUL: A NEW CHIEF WITH BIG PLANS!

Under the leadership of the savvy Zhang Qingsong, a 30-year veteran of China’s banking scene, the fund is on an aggressive expansion spree. After a massive leadership shake-up and fresh stimulus plans, Huijin is now setting its sights beyond traditional investments, diving deeper into ETFs and supplementing its arsenal with controlling stakes in the biggest bad-debt managers!

HUIJIN: YOUR FINANCIAL SITUATION’S BEST FRIEND!

As of June 2024, Central Huijin’s total assets have skyrocketed to a staggering $1.1 trillion! But don’t let the numbers overwhelm you—this fund is now holding dominant shares in financial institutions worth a monstrous $29 trillion! That’s practically the entire treasure chest of China’s financial assets!

HUIJIN’S MARKET STRATEGY: HOLD FOR DEAR LIFE!

In an audacious strategy shift, since early 2024, Central Huijin has made a clear pivot to increased ETF holdings. Following fiery tariffs from Trump, Huijin declared: “We’re stepping up ETF purchases at all costs!” An insider estimates that in April alone, the fund could have splurged Rmb200 billion on ETF treasures!

DON’T EXPECT AN EXIT ANYTIME SOON!

Experts predict this fund won’t be hitting the brakes anytime soon. With stakes getting juicier and markets still recovering from the chaos, we might be looking at a decades-long commitment from Huijin. “I don’t see any risk of a retreat,” claims one analyst. It seems the financial rollercoaster is just starting its ascent!

In a world where market stability is shaky, Central Huijin is pulling out all the stops to secure China’s financial future. Stay tuned for the next thrilling chapter in this breathtaking saga!

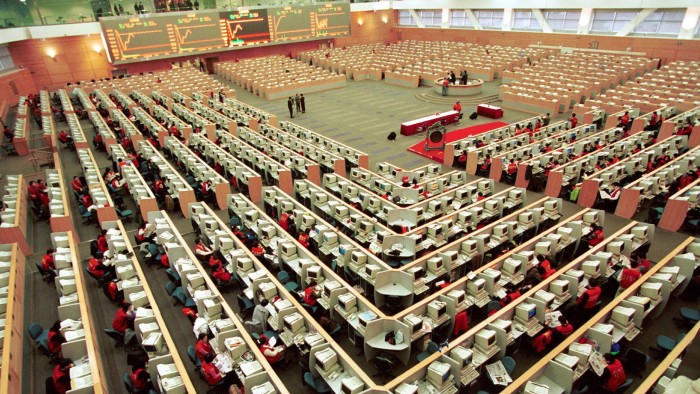

photo credit: www.ft.com

[adrotate group="2"]