[adrotate group="2"]

Campbell’s Company Faces Financial Fiasco! Is the Soup Giant Boiling Over?

Chaos in the Canned Goods Aisle! Campbell’s Company (NASDAQ: CPB) is grappling with a stormy market environment, and it’s NOT looking pretty! Demand for their beloved snack products has hit a soupy slump, while skyrocketing costs threaten to drown profits. As consumers tighten their belts amid relentless inflation, Campbell’s snack sales are expected to take a serious hit!

Mark Your Calendars! When the fourth-quarter FY25 results drop on September 3, Wall Street is bracing for a wild ride, predicting earnings of just $0.57 per share on $2.33 billion in revenue. That’s a drop from the $0.63 per share and $2.29 billion in the same quarter last year! Get ready for the numbers game — will Campbell’s beat the odds again?

Stock Shock! Is Campbell’s on the Brink?

Down, Down, Down Goes the Stock! Campbell’s shares have plunged a jaw-dropping 36% over the last year! This week has seen further declines, with investors bracing for a dismal earnings report. Despite what seems like bargain prices for buyers, the outlook is grim as the potential for a rebound looks limited.

In a surprising twist, Campbell’s recently boosted its dividend, now boasting a whopping 4.9% yield, far surpassing the S&P 500 average! But with sales slipping, can it sustain this generosity?

Mixed Results in a Shaky Quarter

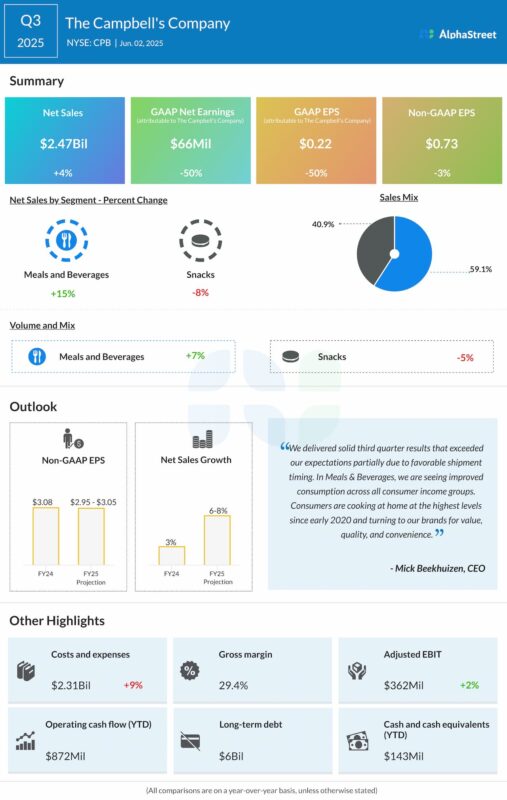

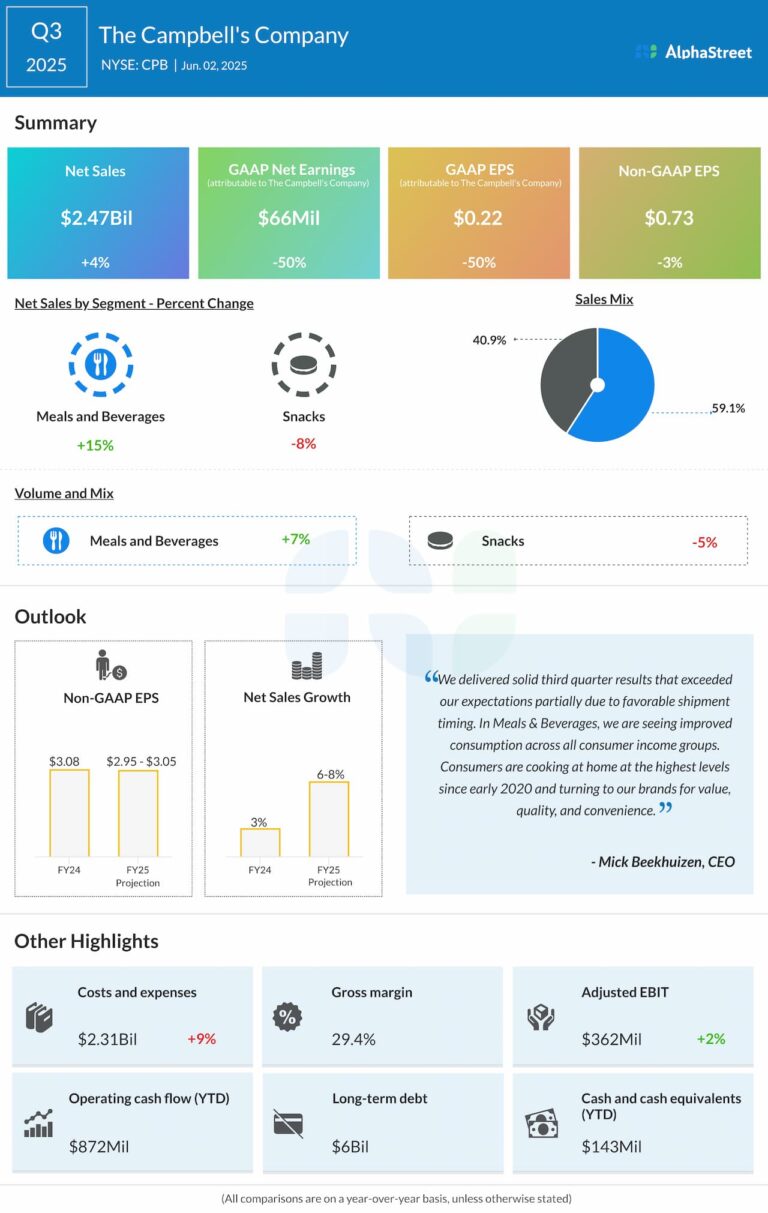

Third Quarter Shockwaves! Campbell’s managed a 4% rise in net sales to $2.47 billion, thanks to a double-digit spike in its Meals & Beverages segment that masked falling Snack sales. But hold onto your spoons – adjusted earnings took a hit, dipping 3% year-over-year to $0.73 per share! With net income plummeting from $133 million to just $66 million, is doom lurking around the corner?

Hot Off the Earnings Call: The company is scrambling to keep consumers interested by showcasing versatile options for home chefs. Their latest “mac and cheese marketing activation” is trying to steer the ship back on course, pushing for sales gains in their condensed cooking portfolio!

What’s Next for Campbell’s? Brace for Impact!

The Future is Cloudy! Campbell’s is forecasting a precarious 6-8% sales growth for fiscal 2025, but warns organic sales may dip 2% or remain flat! Tariffs are throwing a wrench into earnings, leaving adjusted net income projected between $2.95 and $3.05 per share. Are they ready for the wave of normalization expected in Q4?

With the company’s stock startlingly below its 12-month average of $39.65, it’s clear they are navigating choppy waters. With a 20% drop in the last six months, could this soup giant be heading for a colossal meltdown? Stay tuned, because the drama is just beginning!

[adrotate group="2"]