[adrotate group="2"]

Mortgage Meltdown: Can Anyone Save Homebuyers from the Crushing Rates?

Doomsday for Dream Homes? As the housing market teeters on the brink, mortgage rates are STILL sky-high, leaving prospective buyers gasping for air! With rates lingering above a whopping 6%, the once-thriving housing boom—the stuff of pandemic dreams—has morphed into a nightmare!

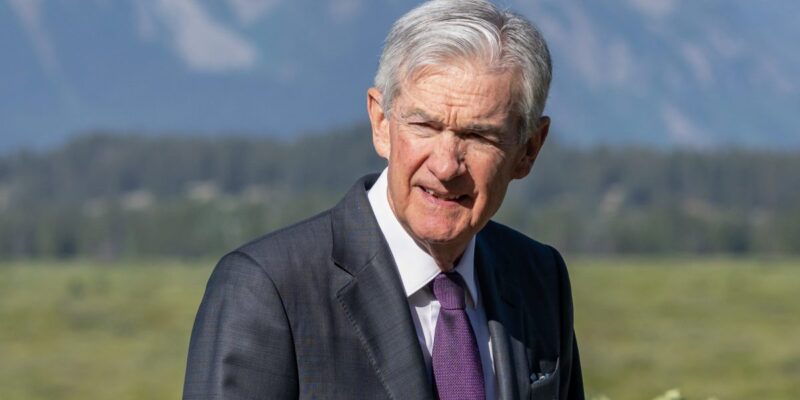

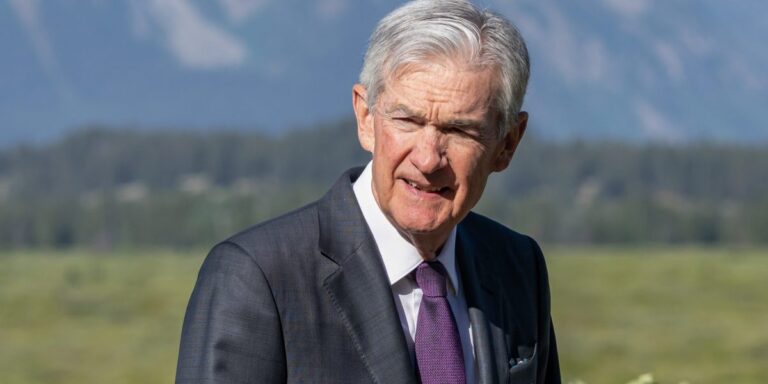

Trump’s Fury and Fed’s Freeze! Former President Donald Trump has been twisting the Federal Reserve’s arm throughout 2025, demanding interest rate cuts as inflation spikes out of control. But Fed Chair Jerome Powell isn’t budging, citing chaos from tariff policies and economic uncertainty. What gives?

Is a Rate Plunge on the Horizon? Bank of America’s mortgage-backed securities (MBS) team surprisingly claims there might be a glimmer of hope—a tantalizing 5% mortgage rate—but only if the Fed works its magic with aggressive yield-curve control and quantitative easing! But don’t hold your breath; many experts think rates will barely dip to 6.25% by the end of 2026. BofA projects a 10-year Treasury yield holding steady around 4.00%—yawn!

A Grizzly Market for Homebuyers! Meanwhile, homebuyers are trapped in a vice, facing the worst affordability crisis in DECADES. The real estate market is moving at a snail’s pace despite Wall Street’s excitement about the potential rate drops. Even with rates falling, affordability remains a cursed riddle!

Economic Apocalypse? If the job market implodes and a recession rears its ugly head, experts predict the Fed could slash rates with reckless abandon! But that might only serve to keep buyers on the sidelines. History shows that even hefty rate cuts haven’t done squat to alleviate affordability woes.

Why Rate Drops Might Not Be Our Savior! Major housing stocks bullrun like D.R. Horton and Lennar are basking in the anticipated cuts, but the cold hard truth is that demand is still DISMAL. Even if rates were to plummet to 4.43%, it wouldn’t make houses affordable in cities like New York or L.A.!

Dream On: First-Time Buyers Are Vanishing! July statistics reveal the number of first-time homebuyers HAS HALVED—YES, you read that right! The housing market is a treacherous battleground, and sharp rate cuts have historically offered little more than a brief respite before reality hits hard.

Time’s Up for Hopeful Buyers! With recent trends showing buyers utterly deflated, it’s clear the housing scene isn’t ready to bounce back! Mortgage rates are trapped in a suffocating grip, and unless something gives, American dream homes could simply remain a dream!

photo credit: fortune.com

[adrotate group="2"]