[adrotate group="2"]

CRITICAL ALERT: PRIVATE CREDIT — NOT A BUBBLE, BUT A FINANCIAL TIME BOMB READY TO EXPLODE!

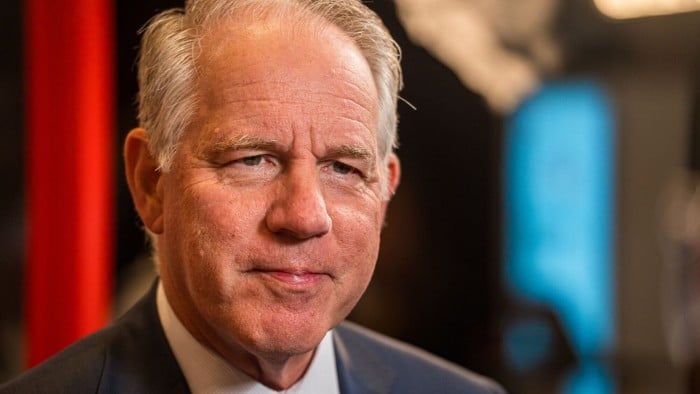

Private credit is under fire! Jim Zelter, the powerhouse president of Apollo Global Management, has thrown down the gauntlet, declaring emphatically that this booming market is NOT a bubble—yet! Speaking at HSBC’s investment extravaganza in Hong Kong, he faced the burning question on everyone’s lips: “Is private credit a bubble ready to burst?” His answer? A nerve-wracking NO! But hold onto your wallets—it gets crazier from here!

Zelter boldly stated that while there’s plenty of speculative activity, we’re not facing the same catastrophic losses as seen in past financial disasters. Are we convinced? Not so fast!

As Apollo continues to dominate the private credit scene, rapidly dishing out loans not just to mid-sized firms but also to GIGANTIC corporations, one thing is crystal clear: the stakes are higher than ever! Forget banks—these private credit firms are taking over, and they’re reeling in investors like moths to a flame, especially as interest rates soar!

The International Monetary Fund (IMF) has waved a red flag, revealing that private credit assets have skyrocketed to a jaw-dropping $2.1 trillion! But beware, folks! This sector has NEVER faced a major economic downturn at this monumental size! If the economy hiccups, watch out—defaults could erupt like a volcanic eruption, leading to devastating markdowns!

Zelter defines private credit as anything plastered on a financial institution’s balance sheet. With the private credit market dubbed a massive "$40 trillion ocean," Apollo’s cut is a whopping $600 billion! Meanwhile, private equity, their supposed “bread and butter,” only rakes in about $100 billion. Talk about a wild game of financial chicken!

Adding to the drama, Zelter described a global economic “tug of war” between inflation and the deflationary forces unleashed by mind-boggling AI and technology. His dire prediction? Inflation is set to steal the spotlight for the next 6 to 18 months before AI brings a wave of upheaval. Buckle up, financial fans! It’s going to be a bumpy—and potentially catastrophic—ride!

With the private credit universe expanding at breakneck speed amid minimal regulation, is it time to sound the alarm? Don’t say we didn’t warn you!

photo credit: www.ft.com

[adrotate group="2"]