[ad_1]

AMD’s Earnings Plunge: Is the Chip Giant Facing a Total Meltdown?

SHOCKING SLUMP! Advanced Micro Devices (AMD) shares took a nosedive, crashing over 6% after the chip titan dropped the ball on earnings, sending investors into a panic.

WHAT WENT WRONG? The Santa Clara-based semiconductor powerhouse reported adjusted earnings of 48 cents per share, missing the analysts’ mark of 49 cents. This blunder raises urgent alarms about the company’s future, especially as fears swirl over the delayed restart of shipments to China.

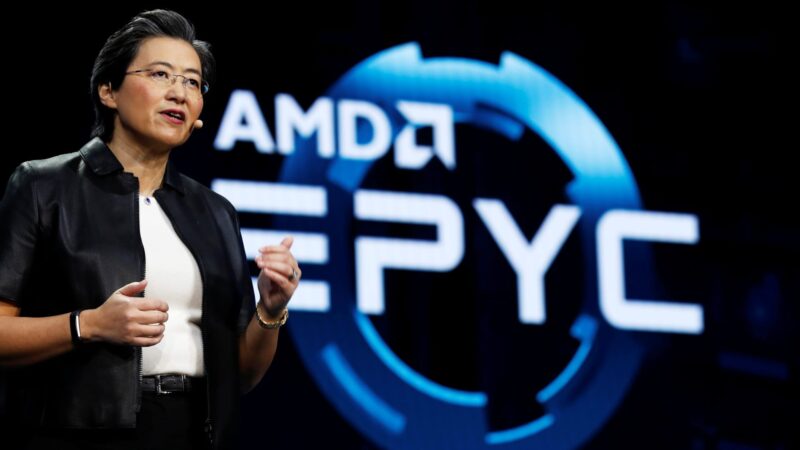

CEO WEIGHS IN: Lisa Su, the megastar CEO, laid the blame on U.S. export restrictions hitting their AI chip sales hard. “AI business revenue is in freefall!” she bellowed during a call with analysts. U.S. policies have all but crushed MI308 sales to the lucrative China market, and with a shift towards their next-generation products, things are looking grim.

FUTURE FORECAST?! AMD is shooting for $8.7 billion in revenue this quarter, a figure that’s just within reach if luck holds. Analysts anticipated $8.3 billion, but guess what? This prediction doesn’t even factor in the MI308 chip—no big deal, just a critical component designed to work around chip restrictions!

PRUDENT OR PANICKING? Su attempted to calm the storm, asserting they’ve been in touch with the Trump administration over the finer points of license requirements. Yet, she confidently touted their strong portfolio, eyeing "tens of billions of dollars" in a future market projected to swell beyond $500 billion. Sounds too good to be true?

$800 MILLION HIT! Earlier this year, AMD’s fortune took a nosedive with an $800 million loss forecast for the second quarter because of these very same sleep-inducing restrictions! Talks of shipments resuming are as murky as ever, with Morgan Stanley calling the timeline “vague.”

ANALYSTS ARE NERVOUS! Experts are increasingly skeptical about how quickly shipments can rebound. Bernstein analysts warned that the promised China upside feels more like a mirage and potential risks loom over inventory and operational costs. Goldman Sachs chimed in, dampening hopes for rapid growth in the vital datacenter market.

ARE THEY EVEN GROWING? The datacenter sector did grow by a modest 14% to $3.2 billion, but will that be enough to stave off disaster? Analysts remain cautious about AMD’s ability to sustain momentum amidst soaring operational expenses.

SU HAS HOPE: In a moment of bravado, Su insisted that AMD sees bullish forecasts from their biggest clients and an "inflection point" could be on the horizon in Q3. “Our datacenter business is the key to our growth strategy!” she declared, promising to seize the opportunities lurking in the shadows.

Despite the earnings debacle, AMD’s revenues have skyrocketed 32% to $7.69 billion, surpassing the anticipated $7.42 billion. Net income soared to $872 million, a stark contrast to last year’s $265 million. But will this be enough to convince nervous investors?

Stay tuned, folks! The drama at AMD is just heating up!

[ad_2]