[adrotate group="2"]

Understanding Cryptocurrency Exchanges

Gaining insights into the different types of cryptocurrency exchanges is essential for navigating the crypto landscape. Each type caters to unique needs and preferences for traders and investors.

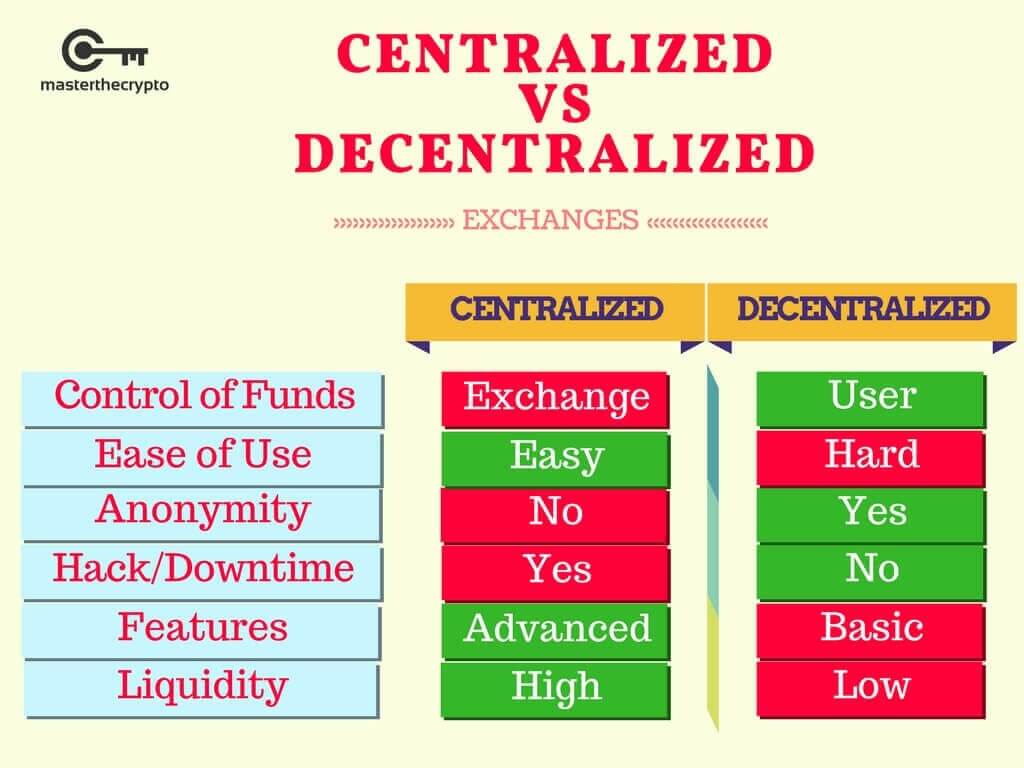

Centralized vs. Decentralized Exchanges

Centralized exchanges (CEXs) like Coinbase and Binance serve as intermediaries for users, facilitating trades in a straightforward manner. These platforms feature user-friendly interfaces that appeal to beginners. However, users give up access to their private keys, increasing vulnerability to hacks and financial failures.

Conversely, decentralized exchanges (DEXs) foster peer-to-peer trading without middlemen. They operate using smart contracts on various blockchain networks, ensuring direct wallet transactions (SoluLab). While DEXs emphasize user autonomy and decentralization, they often lag behind CEXs in terms of user-friendliness and customer support.

| Feature | Centralized Exchanges (CEXs) | Decentralized Exchanges (DEXs) |

|---|---|---|

| Control of Private Keys | No | Yes |

| User Interface | User-friendly | Often less intuitive |

| Security Risk | High (vulnerable to hacks/bankruptcy) | Lower (but at risk of smart contract issues) |

| Regulatory Compliance | Yes | Varies |

| Customer Support | Yes | Limited or absent |

Importance of Private Keys

Private keys are essential for anyone trading cryptocurrencies. They provide access to digital assets. In centralized exchanges, the platform manages users’ private keys, leading to potential problems if the exchange is compromised (CoinLedger).

On DEXs, users control their private keys, giving them full ownership of their cryptocurrencies. This is particularly appealing for seasoned traders who value security. However, handling private keys comes with responsibility—the loss of a key can result in irretrievable asset loss.

The choice between CEXs and DEXs largely depends on personal preferences and risk appetite. Traders seeking simplicity may favor centralized platforms, while those prioritizing security and control may choose decentralized methods. For further exchange comparisons, visit our cryptocurrency exchange comparison and reviews.

Decentralized Exchange Features

Decentralized exchanges (DEXs) provide distinctive features that differentiate them from traditional exchanges. Understanding these characteristics can aid users in making informed trading decisions.

Peer-to-Peer Trading

One key benefit of DEXs is the ability for users to conduct peer-to-peer trades without a central authority. This is facilitated by smart contracts on blockchain networks, allowing direct wallet-to-wallet transactions (SoluLab).

Below is a quick comparison of the peer-to-peer trading process and traditional exchanges:

| Feature | Peer-to-Peer Trading (DEX) | Traditional Exchanges |

|---|---|---|

| Mediator | No | Yes |

| Transaction Speed | Instant | Varies |

| Control of Funds | User retention | Held by the exchange |

| Privacy Level | High | Low |

This direct trading method offers increased control over funds and enhances privacy, allowing transactions without revealing personal details.

Liquidity and Transaction Times

Liquidity indicates how easily an asset can be bought or sold without impacting its price. DEXs exhibit varying liquidity levels depending on available trading pairs and transaction volumes. With generally lower fees, many attract frequent traders, bolstering liquidity (SoluLab).

While transaction times on DEXs can be quick, they can also be influenced by the congestion of the blockchain network. For example, Ethereum-based DEXs like Uniswap can incur gas fees that might lengthen transaction times (Coinbase). Keep the following in mind regarding transaction efficiency:

| Exchange Type | Transaction Time | Typical Fees |

|---|---|---|

| DEX | Generally faster | 0.3% on Uniswap |

| Centralized | Varies; might experience delays | Higher fees |

In summary, the peer-to-peer trading advantages and potentially lower fees position decentralized exchanges as appealing options for cryptocurrency traders. Exploring DEX alternatives can help users identify the right platform for their needs. For detailed comparisons of different platforms, visit our cryptocurrency exchange comparison.

Benefits of Decentralized Exchanges

Decentralized exchanges (DEXs) offer a range of advantages intended to improve the trading experience. Key benefits include enhanced security and user privacy, alongside diminished counterparty risks.

Security and User Privacy

One of the most significant advantages of DEXs is the heightened security they provide. Operating in a decentralized environment means users retain control over their private keys, eliminating the need to deposit funds in potentially vulnerable accounts. This allows for peer-to-peer transactions directly between wallets, thereby minimizing the risk of losing assets to exchange breaches.

Moreover, DEXs prioritize user anonymity. Unlike centralized platforms that often mandate personal information for verification, DEXs facilitate trading without personal disclosure. This aspect is especially appealing for those who prefer to keep their financial activities private.

| Feature | Decentralized Exchanges | Centralized Exchanges |

|---|---|---|

| Control over private keys | Yes | No |

| User privacy | High | Low |

| Risk of hacks | Lower | Higher |

Reduced Counterparty Risks

DEXs effectively lower counterparty risks. In traditional exchanges, there’s always the risk of one party defaulting in a trade. However, on decentralized platforms, transactions occur directly between wallets, significantly reducing one’s exposure to counterparty default (SoluLab).

Additionally, the lack of intermediaries means that DEXs often feature lower transaction fees. For regular traders, this cost advantage is valuable, allowing for maximized returns without high fees. For a breakdown of various options, check our cryptocurrency exchange comparison page.

The combination of increased security, user privacy, and diminished counterparty risks makes DEXs a preferred choice for many users in the cryptocurrency space.

Popular Decentralized Exchanges

Decentralized exchanges (DEXs) create an innovative trading environment, allowing users to interact directly without intermediaries. Among the leading DEXs currently are Uniswap and PancakeSwap.

Uniswap and Ethereum

Uniswap stands as the largest DEX on the Ethereum blockchain, boasting a total value locked (TVL) exceeding $4 billion, making it a market leader among DEXs. It facilitates trades of various cryptocurrency tokens, especially Ethereum and ERC-20 tokens, offering high liquidity and minimal slippage (Koinly).

A noteworthy aspect of Uniswap is its transaction fee structure, which typically charges 0.3% per trade, distributed among liquidity providers. It’s important to bear in mind that this fee could be supplemented by gas fees linked to Ethereum transactions, which can sometimes overshadow Uniswap’s fees (Coinbase).

| Feature | Details |

|---|---|

| Total Value Locked | $4 billion |

| Fee Structure | 0.3% per transaction |

| Platform | Ethereum; supports multiple chains like BNB Smart Chain and Polygon |

PancakeSwap for Binance Smart Chain

PancakeSwap is the top DEX on the Binance Smart Chain, with a TVL of $2.13 billion. It allows for seamless swaps of BEP-20 tokens and offers diverse features such as farms, staking, and lotteries (Koinly).

The platform’s user-friendly design and lower transaction fees compared to Ethereum-based exchanges make PancakeSwap an appealing choice for decentralized trading. Users can trade tokens directly from their wallets without needing to register or verify their identity.

| Feature | Details |

|---|---|

| Total Value Locked | $2.13 billion |

| Token Compatibility | BEP-20 tokens |

| Extra Features | Farms, Staking, Lotteries |

Uniswap and PancakeSwap play critical roles in the dynamic landscape of decentralized exchanges, empowering users to trade without intermediaries while providing unique features tailored for their respective blockchain environments. For additional understanding of how these DEX platforms function, explore our article on cryptocurrency exchange comparisons.

Exploring DEX Options

When evaluating decentralized exchanges (DEXs), it’s essential to consider specific platforms that cater to different trading preferences. Two noteworthy options are Curve, which focuses on stablecoin trading, and dYdX, primarily aimed at perpetual options trading.

Curve for Stablecoin Trading

Curve is a prominent DEX known for its secure trading of stablecoins and pegged cryptocurrencies, holding a TVL of $4.22 billion, consistently ranking among the top platforms in decentralized finance.

The platform excels in providing low slippage and minimal fees for stablecoin trading, making it perfect for those looking for transaction efficiency. Curve’s algorithms are optimized for swapping stable-value assets, which is particularly valuable for stablecoin traders. Here’s a quick overview of Curve:

| Feature | Description |

|---|---|

| Type | Stablecoin DEX |

| TVL | $4.22 billion |

| Slippage | Low |

| Fees | Minimal |

For those interested in comparing different platforms, explore our comprehensive cryptocurrency exchange comparison.

dYdX for Perpetual Options

dYdX is another innovative DEX that specializes in perpetual options trading, supporting over 35 cryptocurrencies and allowing users to trade with leverage of up to 20X. The platform has a TVL of $352 million and enables users to earn rewards through trading and staking DYDX tokens.

dYdX delivers a powerful trading platform for those interested in derivatives trading without sacrificing the benefits of decentralization. Features include margin trading and advanced trading tools that rival their centralized counterparts.

| Feature | Description |

|---|---|

| Type | Perpetual options DEX |

| TVL | $352 million |

| Leverage | Up to 20X |

| Rewards | Earn by trading and staking DYDX tokens |

For those assessing security features and functionalities, explore the list of the most secure crypto exchanges, as well as detailed reviews of cryptocurrency exchanges to make well-informed choices.

Selecting the right DEX is crucial for effective trading strategies, significantly impacting the overall trading experience.

DEX Operational Details

Understanding the operational dynamics of decentralized exchanges (DEXs) is vital for grasping their functionality. Two critical areas to focus on are the trading fees and the innovative models offered by platforms like Balancer.

Fees and Rewards

When participating in decentralized cryptocurrency exchanges, awareness of the associated fees is essential. Various DEXs have different fee structures, which can impact my trading choices. Typically, transaction fees are deducted in the cryptocurrency being traded and can vary based on network congestion and the specific DEX utilized.

The following table summarizes common types of fees linked with DEXs:

| Fee Type | Description | Example DEX |

|---|---|---|

| Trading Fees | A percentage of the trade amount directed to liquidity providers. | Uniswap |

| Gas Fees | Fees required for processing transactions on the blockchain, paid to miners. | Ethereum Network |

| Withdrawal Fees | Fees levied for removing funds from the exchange. | PancakeSwap |

As I engage with various platforms, understanding these fees will help me estimate the total transaction costs and potential rewards from liquidity pool participation.

Index Fund Model with Balancer

Balancer distinguishes itself among DEXs with its unique index fund model. Boasting a total value locked (TVL) of $1.1 billion, it enables users to create diversified portfolios through liquidity pools encompassing up to eight different cryptocurrencies (Koinly). This framework minimizes the risk of impermanent loss for liquidity providers, a prevalent concern in the decentralized finance (DeFi) domain.

A major advantage of Balancer is that it permits me to invest diversely without requiring individual asset management. This convenience is particularly appealing for individuals new to cryptocurrency trading, simplifying the investment process.

To illustrate, here’s how Balancer’s liquidity pools can be structured:

| Pool Name | Allocated Assets | Proportion (%) |

|---|---|---|

| Stablecoin Pool | USDC, DAI, Tether, BUSD | 25% each |

| Governance Token Pool | Uni, AAVE, MKR, SNX, COMP | 20% each |

| Multi-Asset Pool | ETH, BTC, LINK, LTC, DOT, SOL | 15% each |

By investing in diversified liquidity pools on Balancer, I can mitigate risks associated with price fluctuations while still earning rewards through transaction fees. This makes Balancer an intriguing option for anyone entering the world of decentralized exchanges.

For more information on navigating different exchanges, consider checking out our cryptocurrency exchange comparison or read our cryptocurrency exchange reviews.

Factors Influencing Exchange Choice

When selecting a cryptocurrency exchange, various factors come into consideration, particularly user experience and regulatory compliance. Understanding these aspects can assist me in making informed choices while exploring decentralized cryptocurrency exchanges.

User Experience Considerations

User experience is a pivotal consideration in choosing an exchange for cryptocurrency trading. Centralized exchanges, such as Coinbase, are renowned for their user-friendly interfaces, often providing convenient features for buying, selling, and trading cryptocurrencies suitable for novices (CoinLedger). In contrast, decentralized exchanges may present fewer support options and steeper learning curves.

Here are key user experience elements to evaluate:

| Feature | Description |

|---|---|

| Interface | The platform’s layout and navigational ease. |

| Customer Support | Responsiveness and availability of assistance services. |

| Trading Features | Analytical tools and order execution options. |

| Educational Resources | Tutorials or guides assisting beginners in understanding the platform. |

| Transaction Speed | The speed at which orders are executed on the platform. |

As I explore options, a straightforward interface and accessible customer support become crucial—especially for those just starting to navigate the world of cryptocurrency trading.

Regulatory Compliance Awareness

Regulatory compliance is another vital aspect to consider when comparing cryptocurrency exchanges. Centralized exchanges such as Coinbase collaborate closely with regulators to ensure legal compliance in cryptocurrency dealings. They are designed to fulfill compliance features, such as identity verification and customer support (CoinLedger), making them a familiar and secure choice for many users.

In contrast, decentralized exchanges may operate with limited regulatory oversight, offering greater privacy and control over funds but lacking sufficient support for compliance inquiries.

Factors to reflect on regarding regulatory compliance include:

| Compliance Aspect | Centralized Exchange | Decentralized Exchange |

|---|---|---|

| Regulation | Collaborates with regulators | Minimal regulatory oversight |

| Customer Support | Available for compliance guidance | Typically minimal support |

| User Familiarity | High, users often trust established brands | Mixed, as users may require education |

The decision to prioritize user experience or regulatory compliance is based on my specific needs. Users who value simplicity and direct support may prefer centralized exchanges, while those emphasizing privacy and control might opt for decentralized platforms.

For additional insights, I can read our articles on cryptocurrency exchange reviews and comparisons to gather more detailed information.

Future of DEXs

Growth in Decentralized Trading

The DEX landscape is consistently evolving, showcasing promising growth potential. Decentralized exchanges have gained notable traction, especially in developing regions, owing to their offerings like peer-to-peer lending, quick transactions, and the assurance of anonymity. With access via smartphones and internet connectivity, these platforms are widely accessible.

In terms of trading activities, DEXs predominantly facilitate trades involving cryptocurrency tokens rather than fiat currencies, aligning with the overarching trend of an all-digital financial system. The utilization of smart contracts and liquidity pools ensures efficient trades, contributing to the rising volume of decentralized trading.

| Feature | DEXs |

|---|---|

| Peer-to-Peer Trading | Yes |

| Speed | High |

| Anonymity | Yes |

| Fiat Trading | No |

Potential Impact on Traditional Exchanges

Decentralized exchanges challenge traditional exchanges by allowing wallet-to-wallet trades, significantly reducing counterparty risks. This reduction in risk is leading users to prefer DEXs over centralized platforms, which often face vulnerabilities like cyberattacks or service interruptions. As a result, many traders might consider transitioning to DEXs for their transactions, which could impact the volume and revenue generated by traditional exchanges (SoluLab).

In addition to minimizing risks, DEXs typically offer lower fees compared to their centralized counterparts due to the absence of intermediaries (SoluLab). For frequent traders, this cost-advantage can be a significant incentive to switch. Consequently, traditional exchanges might need to respond by lowering their fees, enhancing security, or introducing features that mimic the benefits of DEXs to retain their customer base.

As my understanding of the ecosystem deepens, the future of DEXs signals a shifting power dynamic in the cryptocurrency world. I anticipate growing user adoption that may challenge the traditional exchange model. If you’re interested in comparing various platforms, check out our cryptocurrency exchange comparison for deeper insights.

[adrotate group="2"]