[adrotate group="2"]

STRAP IN: Alibaba’s Earnings Report IS ABOUT TO SHOCK! Is the Tech Giant on the Brink?

Alibaba Group Holding Limited (NYSE: BABA) is racing through a turbulent storm of modernization, AI dreams, and the shadows of past missteps! As investors hold their breath for the first-quarter earnings report, ALL EYES are on whether Alibaba will rise to the occasion or crumble under pressure!

BREAKING: Earnings Set to Tumble!

The financial giants are predicting a dramatic dive in earnings! For Q1 2026, estimates show profits plummeting from ¥16.44 to ¥15.47 (CNY) AD—a nosebleed drop that could send shockwaves through the market! Meanwhile, analysts expect revenues to skyrocket to ¥253.81 billion. Could this be a ray of hope amidst disarray?

STOCK DRAMA: Alibaba Rises, But Can It Last?

Despite being far from its COVID-era glory days, Alibaba’s stock has had a spectacular rebound, soaring by an astonishing 47% in just a year! However, after a promising start to 2025, its performance has stagnated, revealing an undercurrent of investor anxiety amid chaotic restructuring and mixed economic signals. But here’s the kicker—recent gains have put investors on high alert, especially with the whole US-listed Chinese tech scene buzzing!

Earnings Fly High but Expectations FALL FLAT!

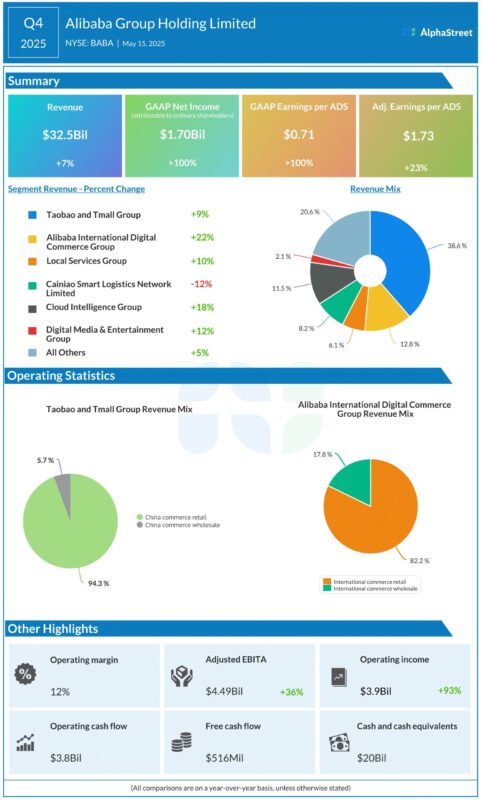

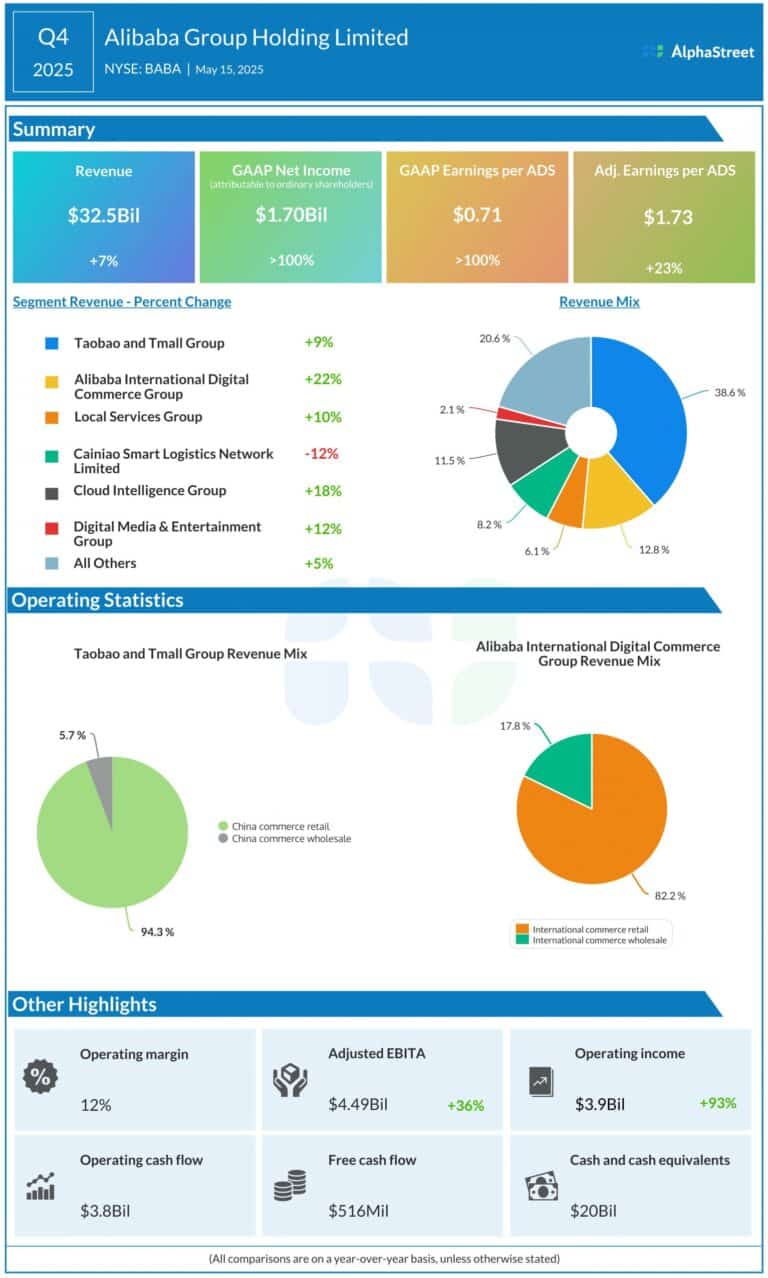

In the fourth quarter of fiscal 2025, Alibaba boasted a revenue increase of 7%, reaching a jaw-dropping $32.5 billion! But wait—there’s a twist! Despite this surge, earnings missed the mark, leading market watchers to question the sustainability of their upward momentum. During this tumultuous quarter, Alibaba executed a $0.6 billion stock buyback, a bold move amidst uncertainty!

WHISTLEBLOWING FROM THE EARNINGS CALL!

"Demand for cloud and AI is soaring—no supply chain hiccup can distract us! Our commitment to innovation is FIRMLY intact!"

FRESH FIGHTS: AI-Infused Innovations on the Horizon!

Hold the phone—Alibaba is stepping up its game with AI-powered glasses, directly challenging heavyweights like Meta! Plus, the controversial restructuring saga continues with a plan to split the company into six sleek units, designed to boost efficiency. And let’s not forget the $433.5 million settlement over the Ant Group IPO disaster that looms over them like a dark cloud.

On Friday, despite its rocky past, Alibaba’s stock made a steady climb, opening at an impressive $120.47, well above its 52-week average of $108.16.

Stay tuned as Alibaba prepares to unveil its latest earnings triumph or disaster—this saga is far from over! Will it skyrocket or sink like a stone?

[adrotate group="2"]