[adrotate group="2"]

401(k) Nightmare: Are You Ready to Hand Over Your Retirement to Risky Private Equity?

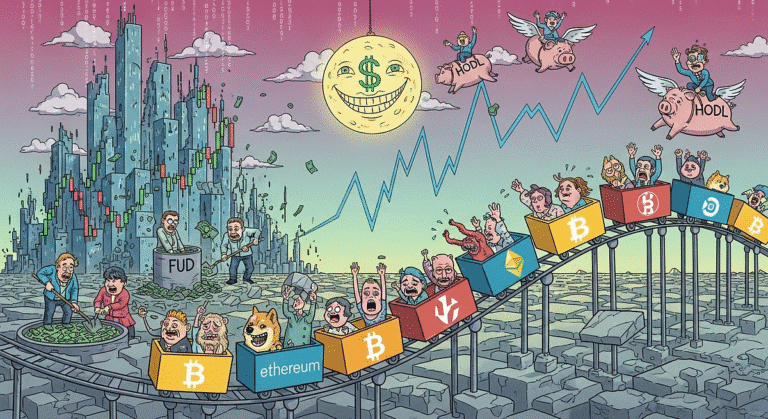

Hold onto your wallets, America! The federal government is shaking things up, trying to let everyday folks dive into the shark-infested waters of private equity with their hard-earned 401(k)s! This is a move that’s screaming "Danger Ahead!" for the average Joe, and we can’t help but wonder – is it really a smart financial play?

Trump’s Wild Executive Order: A Risky Gamble for Your Nest Egg!

Just this month, President Trump signed an explosive executive order, telling the Department of Labor to roll out the red carpet for private equity, cryptocurrency, and real estate in retirement plans. But don’t get too comfortable just yet! This rollercoaster ride comes with a 180-day countdown for new guidelines and lots of potential pitfalls lurking in the shadows.

Fiduciary responsibilities mean that employers typically have to put your interests first. Sure, that sounds good, but what happens when those rules are stretched? The changes could take forever, and worse, a new administration could unravel everything!

The Big Question: Is Choice Actually Good?

So, who’s cheering for this risky maneuver? Surprisingly, the private equity industry itself is doing a happy dance, especially since they poured over $200 million into Trump’s re-election campaign! Empower Retirement, a heavyweight in the retirement plan arena, claims 40% of financial advisors are itching to let workers invest in private equity. But wait—shouldn’t we be skeptical?

While proponents say this gives regular folks a fighting chance against big institutional investors, is playing in their sandbox a smart move? Empower’s CEO claims it’ll boost those retirement accounts, but can we really trust those lofty promises?

Reality Check: Higher Fees, Less Transparency!

Here’s the scary truth, folks: private equity is shrouded in secrecy! Unlike the transparency of publicly traded companies, these funds can hide behind a veil of mystery. They charge exorbitant fees that can skyrocket up to 2%, unlike the mere 0.1% to 0.5% fees typical with regular funds! Investing in private equity could feel like tossing your retirement savings into a black hole—with no reports or signs of life!

Experts warn that most private equity funds don’t deliver better returns, and many are now dropping their holdings faster than a hot potato! What’s worse, ordinary investors might end up with the “leftovers” that sophisticated investors are trying to unload. Doesn’t sound like a sweet deal, does it?

Watch Out for “Zombie Funds” and Greedy Managers!

As if that’s not enough to make you shudder, there’s a rising trend of what critics call “zombie funds.” These funds are clinging to life, charging fees even when they’re not returning value to investors! Moody’s Ratings is sounding the alarm, cautioning that some managers might cut corners and throw money at shady companies just to have something to sell—and you could be the next target!

The Bottom Line: Is This Risk Worth It?

With the potential for massive capital flows from the $12.2 trillion nestled in 401(k)s, the stakes are high. But experts are urging caution, warning that this “exclusive” opportunity might not be what it’s cracked up to be.

Sure, it sounds trendy to brag about private equity at parties, but is it really worth the gambit? The consensus is clear: the average American might be better off sticking to solid ground. Get ready to navigate through the financial jungle—but remember, not every investment is a golden ticket to prosperity!

Stay vigilant because this bold new direction could spell trouble for your retirement. Don’t get caught up in the hype—do your homework and think carefully before you leap!

photo credit: money.com

[adrotate group="2"]