[adrotate group="2"]

JAW-DROPPING EARNINGS REPORT COMING: JOHNSON & JOHNSON’S $22 BILLION SHOWDOWN!

Buckle Up, Investors! July 16 is D-Day!

Prepare for a thrilling ride as healthcare titan Johnson & Johnson (NYSE: JNJ) gears up to unveil its jaw-dropping second-quarter earnings! Experts predict a pulse-pounding adjusted earnings of $2.68 per share on a staggering $22.86 billion in revenues! Dramatic comparisons to last year’s results leaving everyone on the edge of their seat!

PATENTS EXPIRE, MILLIONS AT STAKE!

J&J faces a nail-biting dilemma with looming patent expirations threatening to sink its profits! But hold onto your hats! The company is boldly charging ahead with explosive growth endeavors—from jaw-dropping acquisitions to revolutionary product rollouts! Can they outsmart the lawsuit storm brewing over talc-related cases that could cost MILLIONS? The corporate drama unfolds!

SHOCKING STOCK SWINGS!

In a year filled with gut-wrenching highs and dizzying lows, J&J’s stock has been all over the map! Up about 8% since the start of 2025, but the question remains—can it hold strong? With a recently boosted dividend of 4.8%, the appeal is high, but will the stock survive the storm?

Q1 RECAP: RECORD-BREAKING GAINS!

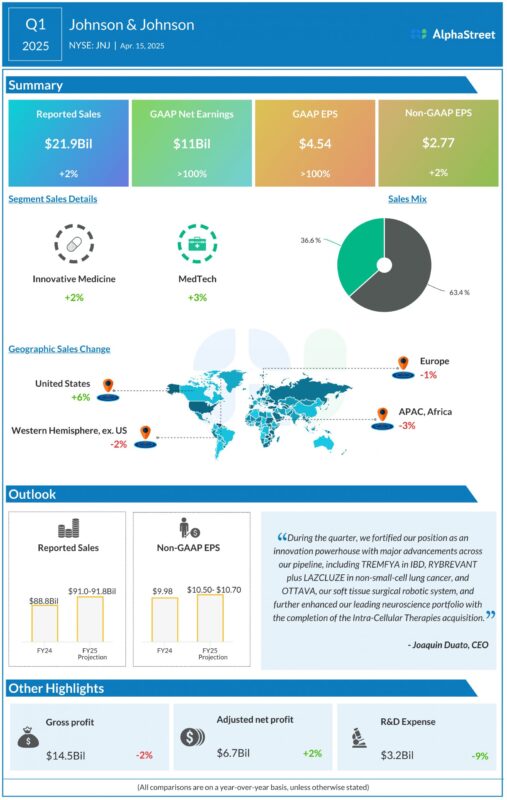

As the first quarter of fiscal 2025 shocked the world with an incredible 2.4% year-over-year sales jump to $21.9 billion, J&J is roaring back! Adjusted earnings soared to $2.77 per share! Investors couldn’t believe their eyes as net income skyrocketed to $4.54 per share! The rumors are true: J&J is on an unstoppable track!

CEO DROPS BOMBSHELL ON EXPANSIVE PLANS!

In a rallying call during the Q1 earnings announcement, CEO Joaquin Duato blasted forth, “We’re investing boldly with FOUR new manufacturing facilities, the first breaking ground in North Carolina. With our latest acquisition of Intra-Cellular Therapies, we’re set to CRUSH analyst expectations!” The stakes are higher than ever!

EYE-POPPING FUTURE OUTLOOK!

As J&J braces for fierce biosimilar competition threatening blockbuster drugs like Stelara, the forecast is spicy! With an audacious commitment of $55 billion to fuel U.S. manufacturing, R&D, and technology over the next four years, can J&J remain in the fast lane?

REVENUE GUIDANCE REVISED UPWARD!

The rollercoaster continues! Just months ago, J&J raised its full-year revenue forecast to a jaw-dropping $91.8 billion! That’s a 3% jump year-over-year! And with blockbuster drugs like Caplyta lighting the way, J&J is primed for a spectacular surge!

With an average stock price of $156.36 over the last year and shares cautiously creeping up to $155.27 in early trading, all eyes are glued to J&J! Will they deliver a blockbuster earnings report, or falter under pressure? July 16 is just around the corner—stay tuned for the financial fireworks!

[adrotate group="2"]