[ad_1]

Market Mayhem! Silence Speaks Volumes as Economic Storms Brew!

Is Disaster Fatigue the Secret Killer of Investor Panic?

For over 30 years, the idea of “social silence” has been overshadowing conversations about economics. But right now, the overwhelming silence across the markets is deafening and laden with tension! It’s as if a shroud of ominous quiet has settled in, despite the chaotic clamor surrounding global affairs.

Trump’s Wild Threats: Should We Be Worried?

This week, the terrifying tension escalated with none other than President Donald Trump ominously hinting that the U.S. "may or may not" leap into Israel’s fiery conflicts with Iran. What’s REALLY boiling beneath the surface? Well, the World Bank has slashed its growth outlook, slapping a gloomy 2.3% on global growth and a miserable 1.4% for the U.S. And guess what? If Trump’s doomsday tariffs trip into play, we could be staring down the barrel of a global trade freeze!

Record Highs and Rational Chaos: What Gives?

Despite the mounting doom and gloom, U.S. equity markets are like a phoenix rising from the ashes, buffing up over 20% since April! It’s wild! Investors are whistling past the graveyard, seemingly unfazed by all the chaos. What’s behind this baffling behavior?

The ‘Taco’ Effect: Have Investors become Complacent?

Experts suggest it’s what’s being dubbed the “Taco Effect” — the notion that Trump loves to threaten but often backs down. Coupled with the time lag phenomenon, the market appears to be in a state of stunning denial. Market reactions to past trade shocks show it can take a year for consequences to surface — talk about a ticking time bomb!

Impending Economic Disasters: Are We Blind to the Reality?

More warnings flood in! The Bank for International Settlements paints a dreary future where uncertainty will decimate investments by 2026. Meanwhile, the grim reality of potential deportations and their crippling economic impact is lurking in the shadows—consequences that might not be felt until 2028!

Shocking Overload: Is the “Death by a Thousand Cuts” Reality?

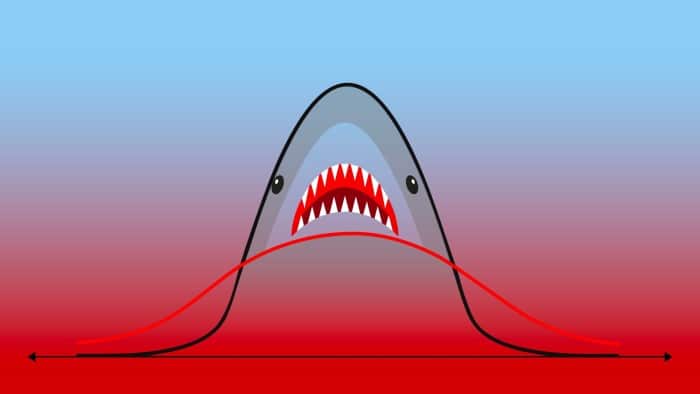

Are investors just too numb to react? With the staggering number of disorienting shocks they face, it’s no wonder they’re in a panic-free daze! The market isn’t hit with one earth-shattering event but instead is grappling with a spreading economic cancer.

Oil Prices and the Abyss: Can We Hold On?

Oil prices sit at a “mere” $75 per barrel, but the looming threat of further explosions in the Middle East could send them soaring. Economists caution that a jump above $100 could ignite economic breakdowns. Investors are caught in a web of unpredictable anxiety, staring at the Inevitable.

Investor Confusion: Can the Market Really Hold?

What does this all mean for equity markets? The current state is like a game of high-stakes poker, where silence may be the loudest player at the table! With uncertainty gnawing at the edges, all it could take is a minor tremor for the whole thing to come crashing down!

In a world where silence can scream the loudest, keep your eyes wide open! Markets are precariously poised, teetering on the brink of potential disaster. Buckle up—this rollercoaster ride is far from over!

photo credit: www.ft.com

[ad_2]