[adrotate group="2"]

DISNEY DARES TO DEFY DOOM: CAN IT OUTSMART A RECESSION?

Buckle Up, Folks! The Walt Disney Company (NYSE: DIS) is steamrolling into fiscal 2025 with a bang! Their streaming service is finally turning the profit tide and blockbuster hits are cashing in big at the box office! But wait! Is the economic storm brewing overhead going to rain on their parade?

Earnings on the Edge!

Disney’s second-quarter results are set to drop like a bombshell on Wednesday, May 7, at 6:40 am ET! Analysts are holding their breath, predicting earnings to stay stagnant at $1.21 per share—yawn! But here’s the juicy tidbit: revenue is expected to skyrocket to $23.13 billion compared to last year’s measly $22.08 billion. Will Disney beat the odds and throw a surprise party?

Despite a dazzling start to the year, investors haven’t been doing the happy dance. DIS shares have plummeted nearly 18% since their last great reveal! They’re hanging out below the 12-month average of $100.31. But hold onto your hats—analysts are buzzing about DIS being a goldmine for long-term investors!

Earnings Victory Lap!

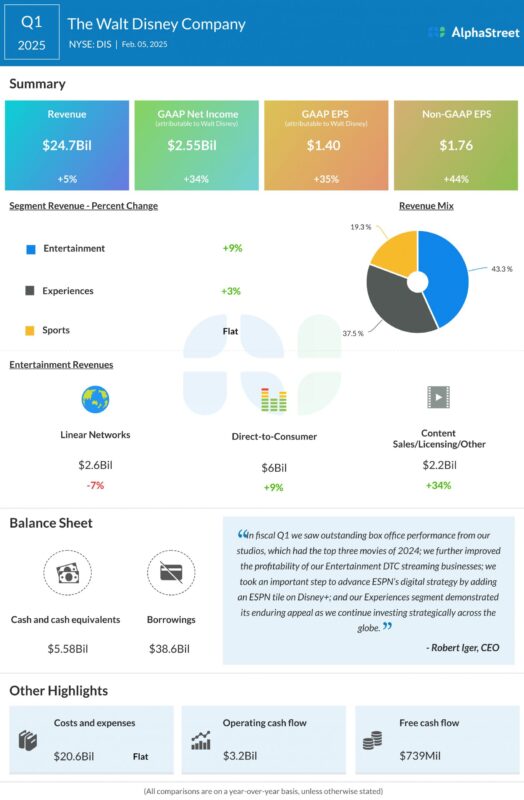

In the first quarter of FY25, Disney’s revenues jumped 5% year-over-year, reaching a staggering $24.7 billion! And get this: adjusted earnings shot up 44%, hitting $1.76 per share—talk about a victory lap! The company’s net income skyrocketed to $2.55 billion, blowing past last year’s numbers! The earnings bar was not just met—it was obliterated!

CEO Robert Iger was practically gleeful during the earnings call, declaring, "We had the TOP 3 movies of 2024 at the global box office!" He’s hyping up even more excitement for this year, teasing fans with upcoming releases tied to Disney’s iconic franchises. From ESPN’s record ratings to the enduring magic of Disney’s Experiences, Iger’s optimism is infectious!

The Crystal Ball Forecast!

Strap in for 2025, because Disney’s management is projecting a high-single-digit growth for adjusted earnings per share! They’re expecting the Experiences division—think theme parks, resorts, and thrilling cruises—to keep that upward momentum going, alongside the burgeoning DTC streaming profits. However, with looming economic shadows and pesky import tariffs, there’s still a chance for turbulence ahead.

But here’s a twist! In what seems like a comeback story, Disney’s shares are climbing back—up 11% over the past month! Will this be the resurgence investors have been waiting for? Keep your eyes peeled as the drama unfolds!

[adrotate group="2"]