[adrotate group="2"]

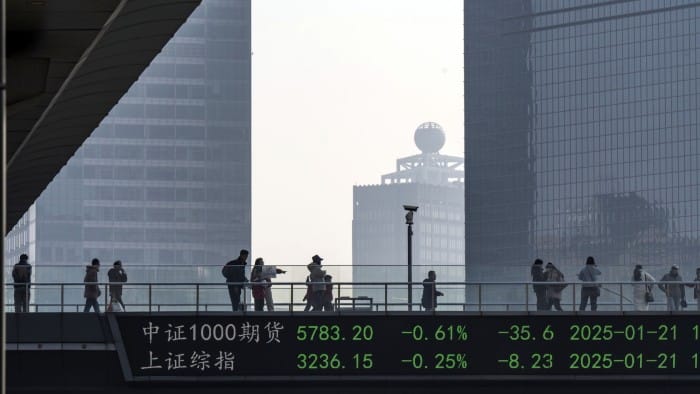

A significant number of American companies operating in China are contemplating or actively pursuing the relocation of some of their operations, as highlighted by a recent study amid rising geopolitical tensions following Donald Trump’s return to the presidency. According to an annual survey by the American Chamber of Commerce in China, 30% of respondents have either been searching for alternative sourcing options or have already started moving their manufacturing activities, a figure that has doubled since 2020.

Michael Hart, the president of AmCham China, noted that while most U.S. companies are not making such moves, the inclination towards relocation is clear. He indicated skepticism about the prospects for increased bilateral investment in the near future, observing that companies are diversifying their supply chains by investing in other locations. This trend raises concerns regarding Chinese investment policy.

As U.S. and Chinese businesses prepare for the potential repercussions of Trump’s protectionist trade strategies, the new president has delayed implementing some of his most severe proposals, including a blanket 60% tariff on Chinese imports. However, he has warned of a possible 10% tariff starting February 1 if China does not address the export of fentanyl precursors.

The AmCham survey, conducted between October and November, revealed that 44% of companies considering relocation cited U.S.-China trade tensions as a primary factor, with many seeking to enhance their supply chains in response to risks exposed during the Covid-19 pandemic. Hart suggested that this trend is unlikely to diminish soon.

The survey indicated that developing Asian countries have become the main target for relocation, with 38% of companies planning to move there. Meanwhile, developed regions, including the U.S., EU, Japan, and South Korea, have also gained appeal. Among various sectors, technology and research and development firms exhibited the highest relocation intentions, with 41% considering or already making moves.

Both the Biden administration and the previous Trump presidency aimed to limit China’s access to advanced technologies, prompting Beijing to respond by restricting exports of essential minerals, contributing to an ongoing technology conflict between the two major economies. The percentage of U.S. firms that do not prioritize China for investment has increased, reaching 21% last year—more than double the figure reported in 2020.

In an effort to attract more foreign investment amidst declining interest, Chinese officials have sought to improve the business environment. However, foreign business sentiment has diminished, influenced by actions such as regulatory crackdowns on consulting firms and unclear regulations regarding cross-border data transfer.

Notably, one-third of U.S. companies surveyed indicated that despite the escalating geopolitical climate, they perceive an improvement in the quality of China’s investment environment, reflecting a five-point increase from the previous year. Hart emphasized the ongoing significance of China as a market, which remains an important message to communicate to stakeholders in the United States. Challenges such as restricted market access and growing competition from domestic businesses continue to be pressing issues for foreign firms in the region.

photo credit: www.ft.com

[adrotate group="2"]