[adrotate group="2"]

Image source: Getty Images

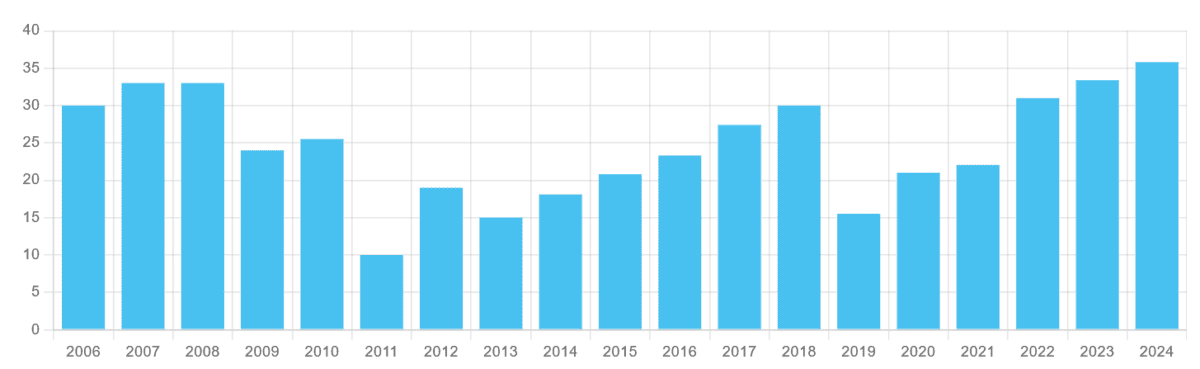

Aviva (LSE:AV.) has been an impressive performer in the FTSE 100 due to its large and growing dividends since 2014, thanks largely to significant restructuring aimed at improving balance sheets and boosting profits.

Similar to many UK companies, Aviva reduced its dividends during the peak of the Covid-19 pandemic, but they have rapidly increased since then, with analysts forecasting further increases in the coming year.

However, dividends are never guaranteed, and it’s crucial to evaluate how realistic the current forecasts are. Should dividend investors consider investing in this FTSE firm for passive income?

Forecasts

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 35.43p | 6% | 7% |

| 2025 | 37.90p | 7% | 7.5% |

| 2026 | 40.49p | 7% | 8% |

As shown, Aviva’s dividend yield is set to reach impressive levels over the next two years, with 8% predicted for next year—more than double the current FTSE 100 average of 3.6%.

Next, we should analyze the dividend cover to determine how well projected payouts are supported by anticipated earnings. A factor of at least 2 times is preferable, as it would allow a company to meet broker expectations even amid unforeseen profit fluctuations.

Regrettably, Aviva does not fare well on this metric, with earnings expected to increase significantly—by 13% in 2025 and 9% in 2026—but dividend cover remains only 1.4 and 1.5 times for those years.

Nonetheless, it’s too early to abandon ship on Aviva. Beyond the cover ratio, the strength of a company’s balance sheet is critical when evaluating future dividends.

Here, Aviva’s performance is much more positive. As of September, its Solvency II capital ratio is an impressive 195%.

This figure is supported by robust cash generation from its general and life insurance sectors, which benefit from stable premium revenue, along with consistent management fees from its asset management operations. It also reflects Aviva’s capital-light business model.

Conclusion

Overall, it appears that Aviva is well-positioned to meet its current dividend forecasts, making it a worthwhile consideration for investors. The company has a solid track record of consistently delivering, even in the face of inadequate dividend cover. I see no signs that this trend will change.

In fact, I am optimistic that it will continue to provide substantial and increasing dividends beyond the forecast period.

Given the competitive landscape of the financial sector, investors should remain cautious. Furthermore, returns may be lackluster in the medium to long term if interest rates remain high.

However, there are plenty of reasons for optimism. Aviva’s strategic shift toward capital-light operations suggests robust future cash flows, and its earnings could grow as cost-saving strategies and acquisitions (like the purchase of Direct Line) come into play.

Additionally, with an increasing elderly population and rising demand for financial planning, there is significant potential for growth in its wealth, protection, and retirement offerings.

I personally hold Aviva shares in my portfolio for passive income and plan to maintain my investment long-term, encouraging other investors to do the same.