[adrotate group="2"]

As we enter 2025, it’s crucial to adopt a thoughtful and analytical perspective on what the year may bring for Bitcoin. By considering various factors, including on-chain data, market cycles, and macroeconomic indicators, we can move beyond mere speculation and construct a data-informed forecast for the upcoming months.

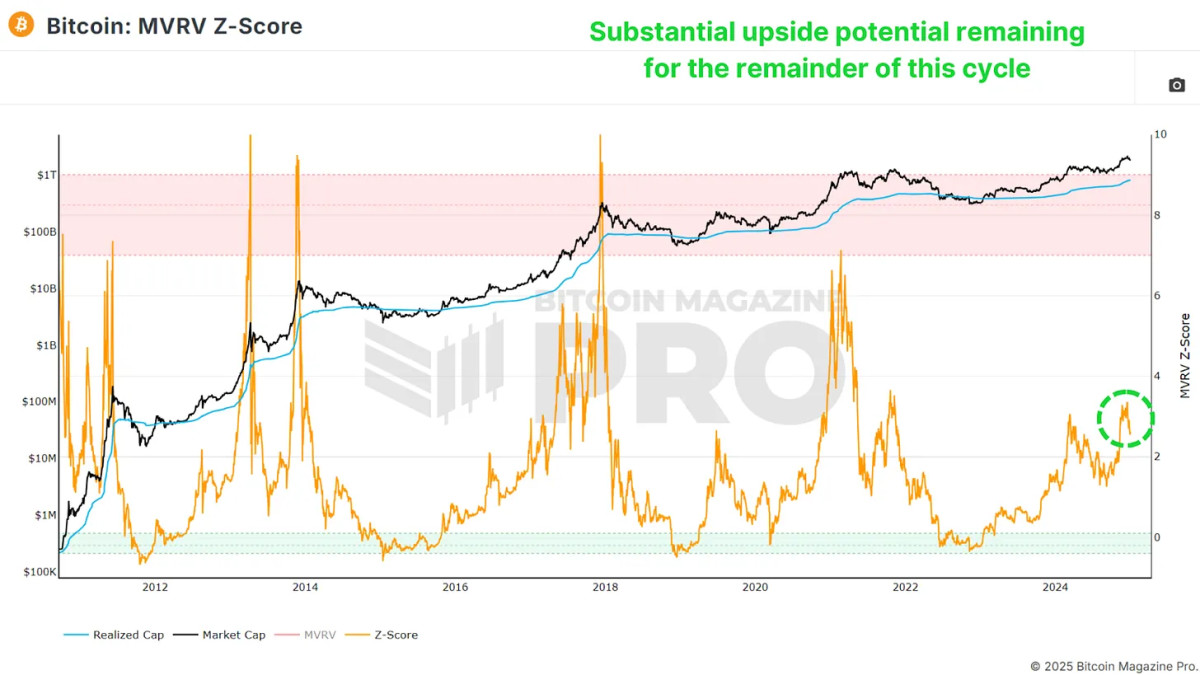

MVRV Z-Score: Significant Upside Ahead

The MVRV Z-Score evaluates the ratio of Bitcoin’s realized price (the average price at which all BTC in circulation was acquired) to its market capitalization. Transforming this ratio for volatility results in the Z-Score, which has historically illustrated market cycles clearly.

View Live Chart 🔍

At present, the MVRV Z-Score indicates that there is still substantial upside potential. While past cycles have seen the Z-Score exceed values of 7, I interpret a score above 6 as a sign of overextension, warranting a closer examination of other indicators to locate a market peak. Currently, we are at levels reminiscent of May 2017, a time when Bitcoin was valued at just a few thousand dollars. Given this historical perspective, there’s ample opportunity for substantial gains from our current position.

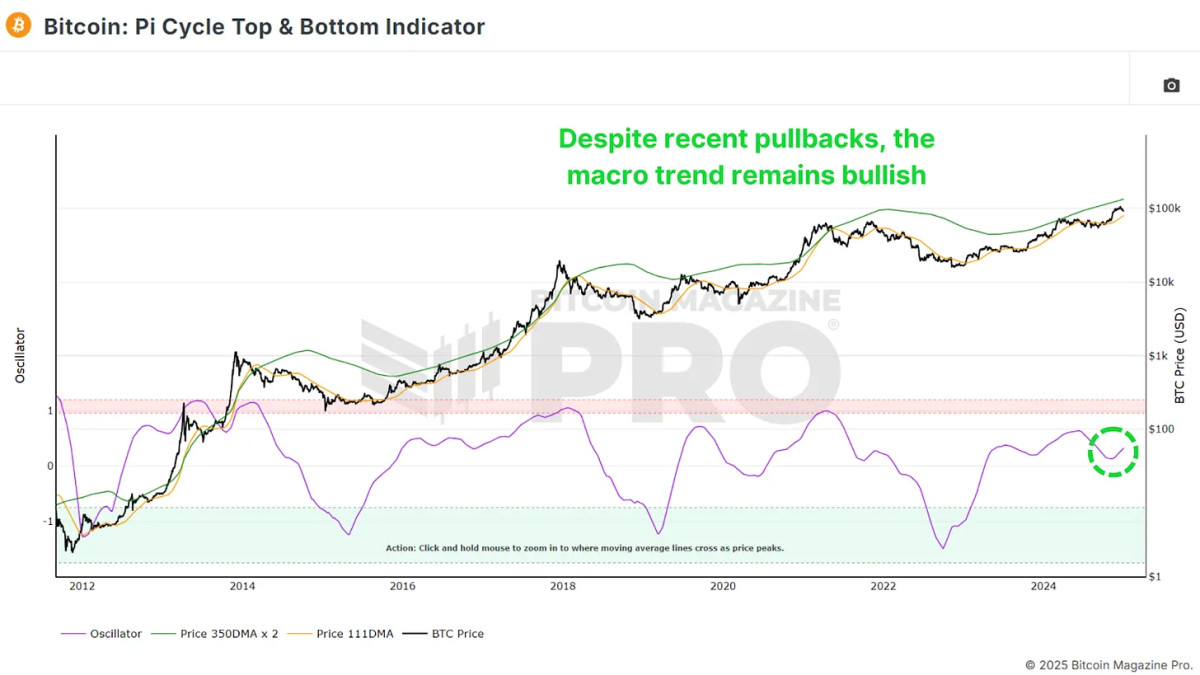

The Pi Cycle Oscillator: Renewed Bullish Momentum

Another critical metric is the Pi Cycle Top and Bottom indicator, which monitors the 111-day and 350-day moving averages (with the latter multiplied by 2). Historically, when these averages intersect, it often signals a price peak for Bitcoin within days.

View Live Chart 🔍

The gap between these two moving averages has begun to rise once more, indicating a return of bullish momentum. While 2024 experienced phases of sideways trading, the current breakout suggests that Bitcoin is entering a robust growth phase that could last several months.

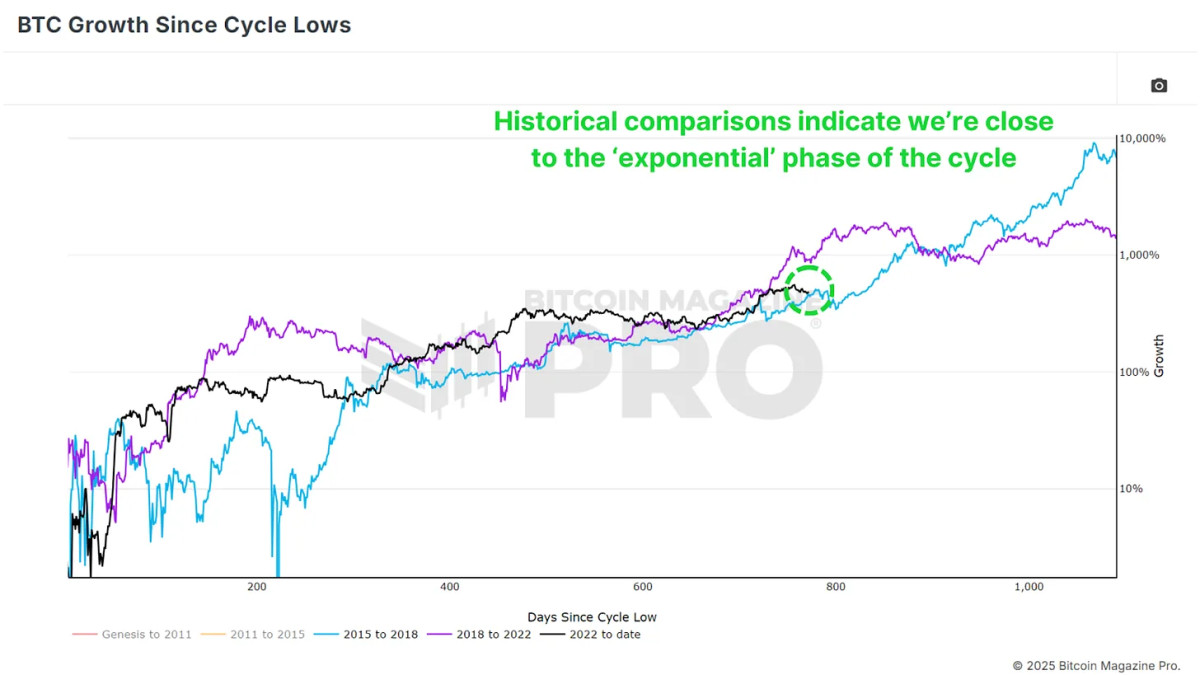

The Exponential Cycle Phase

Examining Bitcoin’s historical price behavior, we see that cycles typically include a “post-halving cooldown” lasting 6–12 months before transitioning into an exponential growth phase. Given historical trends, we are approaching this breakout juncture. Although we might anticipate diminishing returns compared to previous cycles, significant gains could still be achieved.

View Live Chart 🔍

For context, surpassing the prior all-time high of $20,000 in the 2020 cycle resulted in a peak around $70,000—a 3.5x increase. If we achieve even a modest 2x or 3x from the last peak of $70,000, Bitcoin could feasibly hit $140,000 to $210,000 in this cycle.

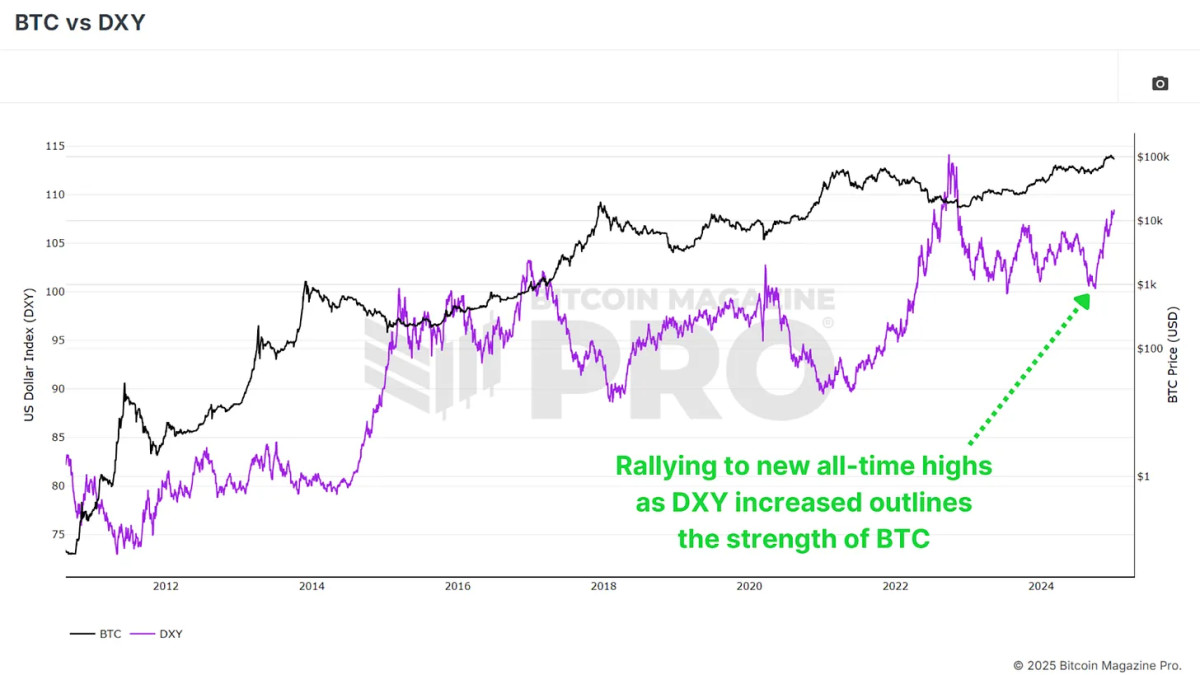

Macroeconomic Factors Favoring Bitcoin in 2025

Even amid challenges in 2024, Bitcoin demonstrated strong performance, despite a strengthening U.S. Dollar Index (DXY). Historically, Bitcoin and the DXY have an inverse relationship, so any decline in DXY strength could further enhance Bitcoin’s upward trajectory.

View Live Chart 🔍

Additional macroeconomic indicators, including high-yield credit cycles and the global M2 money supply, indicate improving conditions for Bitcoin. The monetary contraction witnessed in 2024 is projected to reverse in 2025, creating an even more favorable economic landscape.

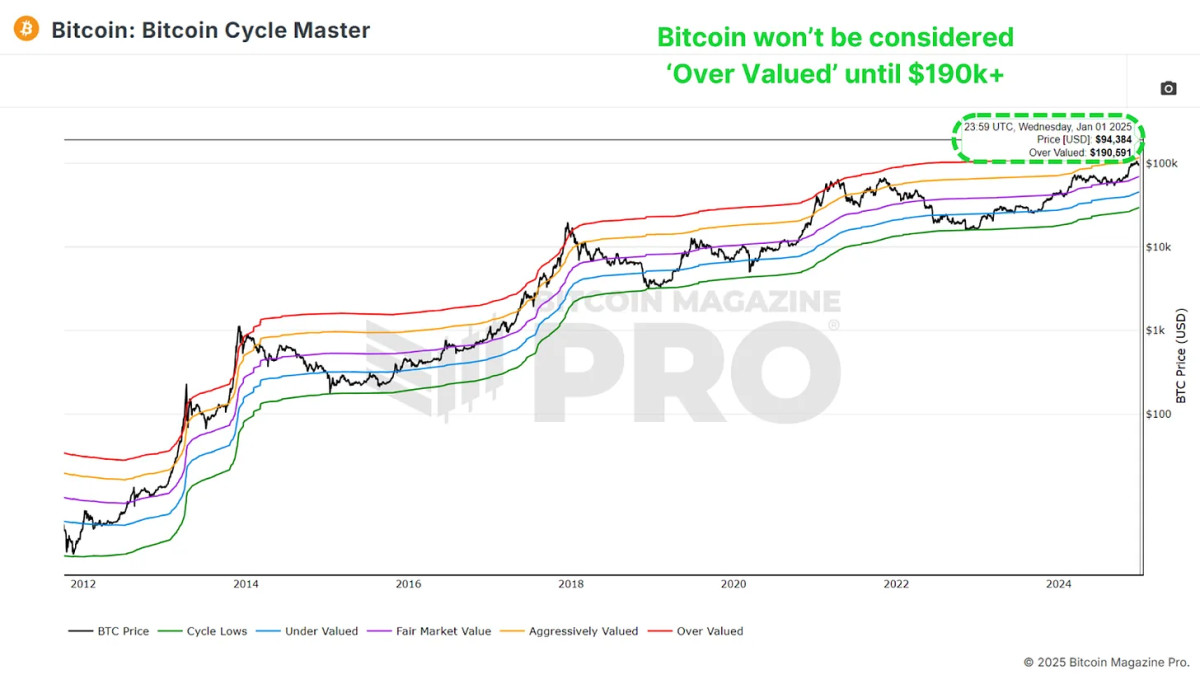

Cycle Master Chart: Significant Growth Potential

The Bitcoin Cycle Master Chart, which compiles various on-chain valuation metrics, reveals that Bitcoin still has ample growth potential before reaching a state of overvaluation. The upper threshold, currently around $190,000, continues to climb, supporting the outlook for sustained upward momentum.

View Live Chart 🔍

Conclusion

At this moment, nearly all indicators point toward a bullish outlook for 2025. While historical performance does not ensure future results, the data strongly suggests that Bitcoin’s most promising days may still be ahead, following an exceptionally positive 2024.

For a deeper exploration of this topic, watch our recent YouTube video: Bitcoin 2025 – A Data Driven Outlook

For further Bitcoin analysis and access to advanced features such as live charts, personalized indicator alerts, and in-depth industry reports, visit Bitcoin Magazine Pro.

Disclaimer: This article is intended for informational purposes only and should not be interpreted as financial advice. Always conduct your own research prior to making any investment decisions.

[adrotate group="2"]